Page 14 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 14

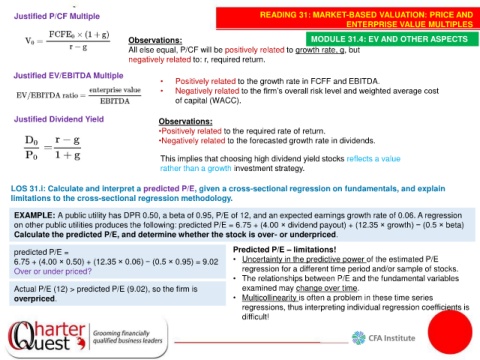

Justified P/CF Multiple READING 31: MARKET-BASED VALUATION: PRICE AND

ENTERPRISE VALUE MULTIPLES

Observations: MODULE 31.4: EV AND OTHER ASPECTS

All else equal, P/CF will be positively related to growth rate, g, but

negatively related to: r, required return.

Justified EV/EBITDA Multiple

• Positively related to the growth rate in FCFF and EBITDA.

• Negatively related to the firm’s overall risk level and weighted average cost

of capital (WACC).

Justified Dividend Yield Observations:

•Positively related to the required rate of return.

•Negatively related to the forecasted growth rate in dividends.

This implies that choosing high dividend yield stocks reflects a value

rather than a growth investment strategy.

LOS 31.i: Calculate and interpret a predicted P/E, given a cross-sectional regression on fundamentals, and explain

limitations to the cross-sectional regression methodology.

EXAMPLE: A public utility has DPR 0.50, a beta of 0.95, P/E of 12, and an expected earnings growth rate of 0.06. A regression

on other public utilities produces the following: predicted P/E = 6.75 + (4.00 × dividend payout) + (12.35 × growth) − (0.5 × beta)

Calculate the predicted P/E, and determine whether the stock is over- or underpriced.

predicted P/E = Predicted P/E – limitations!

6.75 + (4.00 × 0.50) + (12.35 × 0.06) − (0.5 × 0.95) = 9.02 • Uncertainty in the predictive power of the estimated P/E

Over or under priced? regression for a different time period and/or sample of stocks.

• The relationships between P/E and the fundamental variables

Actual P/E (12) > predicted P/E (9.02), so the firm is examined may change over time.

overpriced. • Multicollinearity is often a problem in these time series

regressions, thus interpreting individual regression coefficients is

difficult!