Page 11 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 11

LOS 31.e: Calculate and interpret underlying READING 31: MARKET-BASED VALUATION: PRICE AND

earnings, explain methods of normalizing ENTERPRISE VALUE MULTIPLES

earnings per share (EPS), and calculate

normalized EPS. MODULE 31.4: EV AND OTHER ASPECTS

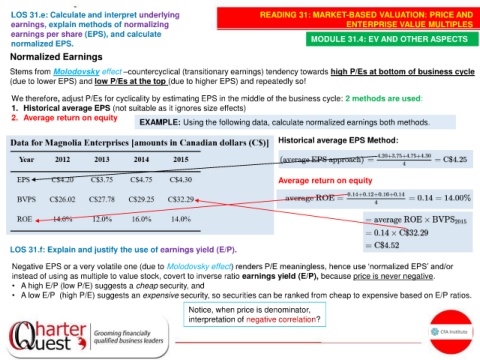

Normalized Earnings

Stems from Molodovsky effect –countercyclical (transitionary earnings) tendency towards high P/Es at bottom of business cycle

(due to lower EPS) and low P/Es at the top (due to higher EPS) and repeatedly so!

We therefore, adjust P/Es for cyclicality by estimating EPS in the middle of the business cycle: 2 methods are used:

1. Historical average EPS (not suitable as it ignores size effects)

2. Average return on equity

EXAMPLE: Using the following data, calculate normalized earnings both methods.

Historical average EPS Method:

Average return on equity

LOS 31.f: Explain and justify the use of earnings yield (E/P).

Negative EPS or a very volatile one (due to Molodovsky effect) renders P/E meaningless, hence use ‘normalized EPS’ and/or

instead of using as multiple to value stock, covert to inverse ratio earnings yield (E/P), because price is never negative.

• A high E/P (low P/E) suggests a cheap security, and

• A low E/P (high P/E) suggests an expensive security, so securities can be ranked from cheap to expensive based on E/P ratios.

Notice, when price is denominator,

interpretation of negative correlation?