Page 6 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 6

LOS 31.b: Calculate and interpret a justified price multiple. READING 31: MARKET-BASED VALUATION: PRICE AND

LOS 31.c: Describe rationales for and possible drawbacks ENTERPRISE VALUE MULTIPLES

to using alternative price multiples and dividend yield in

valuation. MODULE 31.2: P/B MULTIPLE

LOS 31.d: Calculate and interpret alternative price multiples

and dividend yield.

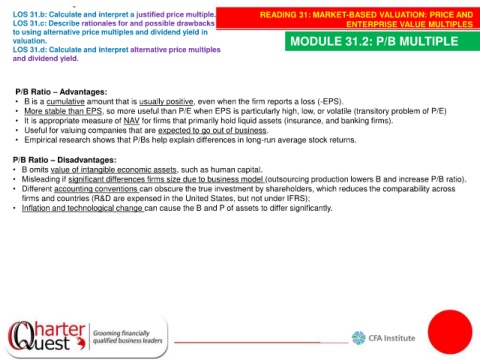

P/B Ratio – Advantages:

• B is a cumulative amount that is usually positive, even when the firm reports a loss (-EPS).

• More stable than EPS, so more useful than P/E when EPS is particularly high, low, or volatile (transitory problem of P/E)

• It is appropriate measure of NAV for firms that primarily hold liquid assets (insurance, and banking firms).

• Useful for valuing companies that are expected to go out of business.

• Empirical research shows that P/Bs help explain differences in long-run average stock returns.

P/B Ratio – Disadvantages:

• B omits value of intangible economic assets, such as human capital.

• Misleading if significant differences firms size due to business model (outsourcing production lowers B and increase P/B ratio).

• Different accounting conventions can obscure the true investment by shareholders, which reduces the comparability across

firms and countries (R&D are expensed in the United States, but not under IFRS);

• Inflation and technological change can cause the B and P of assets to differ significantly.