Page 9 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 9

LOS 31.b: Calculate and interpret a justified price multiple. READING 31: MARKET-BASED VALUATION: PRICE AND

LOS 31.c: Describe rationales for and possible drawbacks ENTERPRISE VALUE MULTIPLES

to using alternative price multiples and dividend yield in

valuation. MODULE 31.4: EV AND OTHER ASPECTS

LOS 31.d: Calculate and interpret alternative price

multiples and dividend yield.

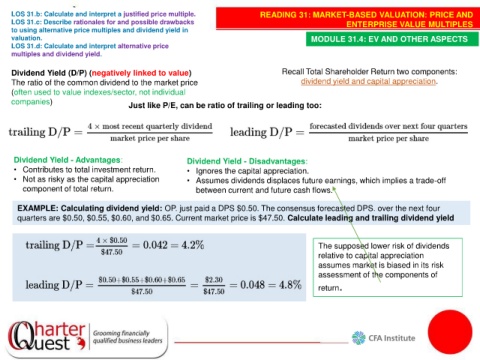

Dividend Yield (D/P) (negatively linked to value) Recall Total Shareholder Return two components:

The ratio of the common dividend to the market price dividend yield and capital appreciation.

(often used to value indexes/sector, not individual

companies)

Just like P/E, can be ratio of trailing or leading too:

Dividend Yield - Advantages: Dividend Yield - Disadvantages:

• Contributes to total investment return. • Ignores the capital appreciation.

• Not as risky as the capital appreciation • Assumes dividends displaces future earnings, which implies a trade-off

component of total return. between current and future cash flows.

EXAMPLE: Calculating dividend yield: OP. just paid a DPS $0.50. The consensus forecasted DPS. over the next four

quarters are $0.50, $0.55, $0.60, and $0.65. Current market price is $47.50. Calculate leading and trailing dividend yield

The supposed lower risk of dividends

relative to capital appreciation

assumes market is biased in its risk

assessment of the components of

return.