Page 10 - FINAL CFA II SLIDES JUNE 2019 DAY 8

P. 10

LOS 31.e: Calculate and interpret underlying READING 31: MARKET-BASED VALUATION: PRICE AND

earnings, explain methods of normalizing ENTERPRISE VALUE MULTIPLES

earnings per share (EPS), and calculate

normalized EPS. MODULE 31.4: EV AND OTHER ASPECTS

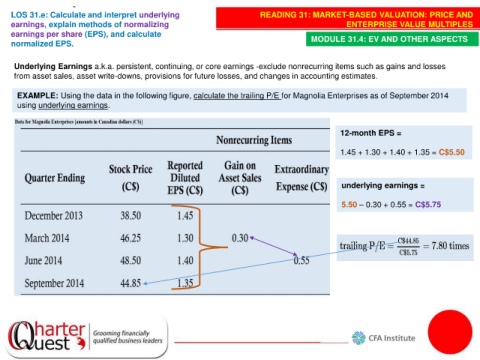

Underlying Earnings a.k.a. persistent, continuing, or core earnings -exclude nonrecurring items such as gains and losses

from asset sales, asset write-downs, provisions for future losses, and changes in accounting estimates.

EXAMPLE: Using the data in the following figure, calculate the trailing P/E for Magnolia Enterprises as of September 2014

using underlying earnings.

12-month EPS =

1.45 + 1.30 + 1.40 + 1.35 = C$5.50

underlying earnings =

5.50 – 0.30 + 0.55 = C$5.75