Page 8 - Improved +Example+Assessment+Report (LG Accrual) {FlipBook Test v1}_Neat (Online upload)

P. 8

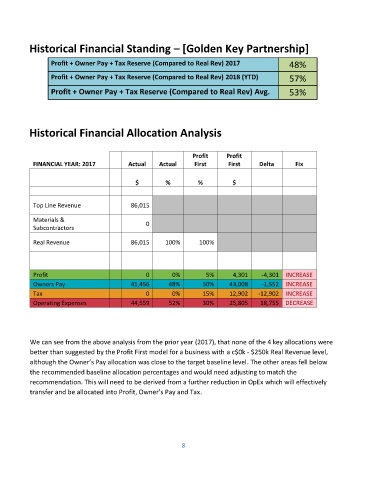

Historical Financial Standing – [Golden Key Partnership]

Profit + Owner Pay + Tax Reserve (Compared to Real Rev) 2017 48%

Profit + Owner Pay + Tax Reserve (Compared to Real Rev) 2018 (YTD) 57%

Profit + Owner Pay + Tax Reserve (Compared to Real Rev) Avg. 53%

Historical Financial Allocation Analysis

Profit Profit

FINANCIAL YEAR: 2017 Actual Actual First First Delta Fix

$ % % $

Top Line Revenue 86,015

Materials &

Subcontractors 0

Real Revenue 86,015 100% 100%

Profit 0 0% 5% 4,301 -4,301 INCREASE

Owners Pay 41,456 48% 50% 43,008 -1,552 INCREASE

Tax 0 0% 15% 12,902 -12,902 INCREASE

Operating Expenses 44,559 52% 30% 25,805 18,755 DECREASE

We can see from the above analysis from the prior year (2017), that none of the 4 key allocations were

better than suggested by the Profit First model for a business with a c$0k - $250k Real Revenue level,

although the Owner’s Pay allocation was close to the target baseline level. The other areas fell below

the recommended baseline allocation percentages and would need adjusting to match the

recommendation. This will need to be derived from a further reduction in OpEx which will effectively

transfer and be allocated into Profit, Owner’s Pay and Tax.

8