Page 9 - Improved +Example+Assessment+Report (LG Accrual) {FlipBook Test v1}_Neat (Online upload)

P. 9

Profit First Assessment

Profit First Financial Allocation Analysis

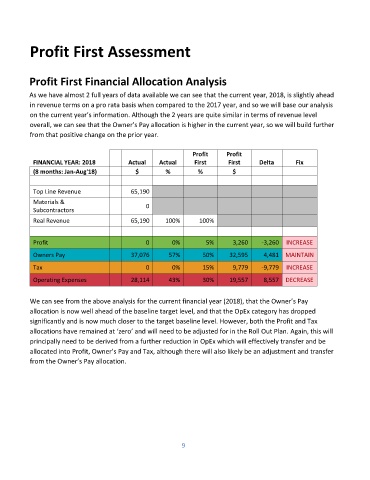

As we have almost 2 full years of data available we can see that the current year, 2018, is slightly ahead

in revenue terms on a pro rata basis when compared to the 2017 year, and so we will base our analysis

on the current year’s information. Although the 2 years are quite similar in terms of revenue level

overall, we can see that the Owner’s Pay allocation is higher in the current year, so we will build further

from that positive change on the prior year.

Profit Profit

FINANCIAL YEAR: 2018 Actual Actual First First Delta Fix

(8 months: Jan-Aug'18) $ % % $

Top Line Revenue 65,190

Materials & 0

Subcontractors

Real Revenue 65,190 100% 100%

Profit 0 0% 5% 3,260 -3,260 INCREASE

Owners Pay 37,076 57% 50% 32,595 4,481 MAINTAIN

Tax 0 0% 15% 9,779 -9,779 INCREASE

Operating Expenses 28,114 43% 30% 19,557 8,557 DECREASE

We can see from the above analysis for the current financial year (2018), that the Owner’s Pay

allocation is now well ahead of the baseline target level, and that the OpEx category has dropped

significantly and is now much closer to the target baseline level. However, both the Profit and Tax

allocations have remained at ‘zero’ and will need to be adjusted for in the Roll Out Plan. Again, this will

principally need to be derived from a further reduction in OpEx which will effectively transfer and be

allocated into Profit, Owner’s Pay and Tax, although there will also likely be an adjustment and transfer

from the Owner’s Pay allocation.

9