Page 444 - AR DPBM-2016--SMALL

P. 444

Ikhtisar Utama Laporan Manajemen Profil Dana Pensiun Bank Mandiri

Key Financial Highlights Management Report Dana Pensiun Bank Mandiri Profile

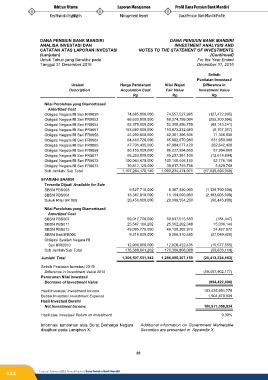

DANA PENSIUN BANK MANDIRI DANA PENSIUN BANK MANDIRI

ANALISA INVESTASI DAN INVESTMENT ANALYSIS AND

CATATAN ATAS LAPORAN INVESTASI NOTES TO THE STATEMENT OF INVESTMENTS

(Lanjutan) (Continued)

Untuk Tahun yang Berakhir pada For the Year Ended

Tanggal 31 Desember 2016 December 31, 2016

Selisih

Penilaian Investasi/

Uraian/ Harga Perolehan/ Nilai Wajar/ Difference in

Description Acquisition Cost Fair Value Investment Value

Rp Rp Rp

Nilai Perolehan yang Diamortisasi/

Amortized Cost

Obligasi Negara RI Seri FR0050 74,685,000,000 74,557,527,995 (127,472,005)

Obligasi Negara RI Seri FR0052 68,630,000,000 68,374,799,004 (255,200,996)

Obligasi Negara RI Seri FR0054 52,375,000,000 52,305,856,759 (69,143,241)

Obligasi Negara RI Seri FR0057 153,680,000,000 153,673,232,683 (6,767,317)

Obligasi Negara RI Seri FR0058 42,290,000,000 42,361,306,935 71,306,935

Obligasi Negara RI Seri FR0064 64,460,720,000 65,092,670,980 631,950,980

Obligasi Negara RI Seri FR0065 47,701,435,000 47,984,077,420 282,642,420

Obligasi Negara RI Seri FR0068 86,150,000,000 86,237,994,860 87,994,860

Obligasi Negara RI Seri FR0071 65,250,000,000 65,237,381,106 (12,618,894)

Obligasi Negara RI Seri FR0072 100,064,670,000 100,148,446,150 83,776,150

Obligasi Negara RI Seri FR0073 39,812,120,000 39,817,749,768 5,629,768

Sub Jumlah/ Sub Total 1,107,264,170,140 1,090,234,474,071 (17,029,696,069)

SYARIAH/ SHARIA

Tersedia Dijual/ Available for Sale

SBSN PBS003 9,527,710,000 8,387,920,000 (1,139,790,000)

SBSN PBS004 13,347,010,000 11,164,005,000 (2,183,005,000)

Sukuk Ritel SR 008 20,456,000,000 20,399,554,200 (56,445,800)

Nilai Perolehan yang Diamortisasi/

Amortized Cost

SBSN PBS007 59,017,700,000 59,017,515,553 (184,447)

SBSN PBS011 25,547,166,202 25,562,202,348 15,036,146

SBSN PBS012 49,095,775,000 49,120,202,972 24,427,972

SBSN Seri IFR006 9,316,000,000 9,288,910,580 (27,089,420)

Obligasi Syariah Negara RI

Seri IFR0010 12,936,000,000 12,920,422,435 (15,577,565)

Sub Jumlah/Sub Total 176,368,641,202 176,308,808,088 (59,833,114)

Jumlah/ Total 1,306,507,531,342 1,286,095,207,159 (20,412,324,183)

Selisih Penilaian Investasi 2015/

Difference in Investment Value 2015 (19,457,902,177)

Penurunan Nilai Investasi/

Decrease of Investment Value (954,422,006)

Hasil Investasi/ Investment Income 103,435,951,779

Beban Investasi/ Investment Expense 1,504,470,939

Hasil Investasi Bersih/

Net Investment Income 100,977,058,834

Hasil atas Investasi/ Return on Investment 9.30%

Informasi tambahan atas Surat Berharga Negara Additional information on Government Marketable

disajikan pada Lampiran X. Securities are presented in Appendix X.

Final draft/March 2, 2017 paraf:

28

444 Laporan Tahunan 2016 Annual Report | Dana Pensiun Bank Mandiri