Page 54 - FY18 Advanced Services Strategic Plan

P. 54

Security market profile

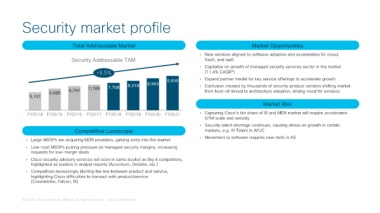

Total Addressable Market Market Opportunities

• New services aligned to software adoption and acceleration for cloud,

Security Addressable TAM SaaS, and IaaS

• Capitalize on growth of managed security services sector in the market

+9.5% (11.4% CAGR*)

9,650 • Expand partner model for key service offerings to accelerate growth

8,963

8,318

• Confusion created by thousands of security product vendors shifting market

6,085 6,797 7,186 7,708 from best-of-breed to architecture adoption, driving need for services

5,101

Market Risk

FY2014 FY2015 FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 • Capturing Cisco’s fair share of IR and MDR market will require accelerated

GTM scale and velocity

• Security talent shortage continues, causing stress on growth in certain

Competitive Landscape markets, e.g. IR Talent in APJC

• Movement to software requires new skills in AS

• Large MSSPs are acquiring MDR providers, gaining entry into the market

• Low-cost MSSPs putting pressure on managed security margins, increasing

requests for low-margin deals

• Cisco security advisory services not seen in same bucket as Big 4 competitors,

highlighted as leaders in analyst reports (Accenture, Deloitte, etc.)

• Competitors increasingly blurring the line between product and service,

highlighting Cisco difficulties to transact with product/service

(Crowdstrike, Falcon, IR)

© 2018 Cisco and/or its affiliates. All rights reserved. Cisco Confidential