Page 15 - Norco Patient Orientation Handbook e-book

P. 15

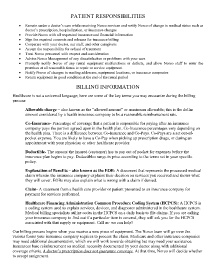

PATIENT RESPONSIBILITIES

• Remain under a doctor’s care while receiving Norco services and notify Norco of change in medical status such as

doctor’s prescription, hospitalization, or insurance changes

• Provide Norco with all requested insurance and financial information

• Sign the required consents and releases for insurance billing

• Cooperate with your doctor, our staff, and other caregivers

• Accept the responsibility for refusal of treatment

• Treat Norco personnel with respect and consideration

• Advise Norco Management of any dissatisfaction or problems with your care

• Promptly notify Norco of any rental equipment malfunctions or defects, and allow Norco staff to enter the

premises at all reasonable times to repair or service equipment

• Notify Norco of changes in mailing addresses, equipment locations, or insurance companies

• Return equipment in good condition at the end of the rental period

BILLING INFORMATION

Healthcare is not a universal language; here are some of the key terms you may encounter during the billing

process:

Allowable charge – also known as the “allowed amount” or maximum allowable; this is the dollar

amount considered by a health insurance company to be a reasonable reimbursement rate.

Co-Insurance- Percentage of coverage that a patient is responsible for paying after an insurance

company pays the portion agreed upon in the health plan. Co-Insurance percentages vary depending on

the health plan. There is a difference between Co-Insurance and Co-Pays. Co-Pays are a set out-of-

pocket expense. You are likely to have a Co-Pay when picking up prescription drugs, or during an

appointment with your physician or other healthcare provider.

Deductible- The amount the insured (customer) has to pay out of pocket for expenses before the

insurance plan begins to pay. Deductibles range in price according to the terms set in your specific

policy.

Explanation of Benefits – also known as the EOB- A document that represents the processed medical

claim wherein the insurance company explains their decision on services you received and shows what

they will cover. EOBs may also explain what is wrong with a claim if denied.

Claim- A statement from a health care provider or patient presented to an insurance company for

payment for services performed.

Healthcare Financing Administration Common Procedure Coding System (HCPCS): A HCPCS is

a coding system used to explain services, devices, and diagnoses administered in the healthcare system.

Medical billing specialists utilize codes in the HCPCS on a daily basis to file claims. If you are calling

your insurance company to find out if a particular item is covered, they will ask you for the HCPCS

associated with that supply or equipment. Call us- we can help!

Our billing process begins when you receive a new piece of equipment. The Norco team will go over the

various forms your insurance company requires to process the claim. Medicare and other insurance companies

may need additional documentation, which we will work towards obtaining but may need your assistance.

Insurances base reimbursement on medical necessity documented by your doctor along with additional

coverage criteria. A doctor’s prescription does not guarantee coverage. At that time, Norco will decide whether

to accept assignment.