Page 321 - Washington Nonprofit Handbook 2018 Edition

P. 321

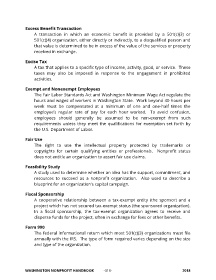

Excess Benefit Transaction

A transaction in which an economic benefit is provided by a 501(c)(3) or

501(c)(4) organization, either directly or indirectly, to a disqualified person and

that value is determined to be in excess of the value of the services or property

received in exchange.

Excise Tax

A tax that applies to a specific type of income, activity, good, or service. These

taxes may also be imposed in response to the engagement in prohibited

activities.

Exempt and Nonexempt Employees

The Fair Labor Standards Act and Washington Minimum Wage Act regulate the

hours and wages of workers in Washington State. Work beyond 40 hours per

week must be compensated at a minimum of one and one-half times the

employee’s regular rate of pay for each hour worked. To avoid confusion,

employees should generally be assumed to be non-exempt from such

requirements unless they meet the qualifications for exemption set forth by

the U.S. Department of Labor.

Fair Use

The right to use the intellectual property protected by trademarks or

copyrights for certain qualifying entities or professionals. Nonprofit status

does not entitle an organization to assert fair use claims.

Feasibility Study

A study used to determine whether an idea has the support, commitment, and

resources to succeed as a nonprofit organization. Also used to describe a

blueprint for an organization’s capital campaign.

Fiscal Sponsorship

A cooperative relationship between a tax-exempt entity (the sponsor) and a

project which has not secured tax-exempt status (the sponsored organization).

In a fiscal sponsorship, the tax-exempt organization agrees to receive and

disperse funds for the project, often in exchange for fees or other benefits.

Form 990

The federal informational return which most 501(c)(3) organizations must file

annually with the IRS. The type of form required varies depending on the size

and type of the organization.

WASHINGTON NONPROFIT HANDBOOK -310- 2018