Page 324 - Washington Nonprofit Handbook 2018 Edition

P. 324

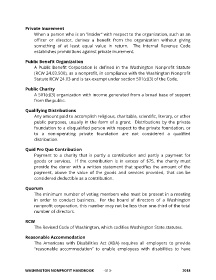

Private Inurement

When a person who is an “insider” with respect to the organization, such as an

officer or director, derives a benefit from the organization without giving

something of at least equal value in return. The Internal Revenue Code

establishes prohibitions against private inurement.

Public Benefit Organization

A Public Benefit Corporation is defined in the Washington Nonprofit Statute

(RCW 24.03.500), as a nonprofit, in compliance with the Washington Nonprofit

Statute RCW 24.03 and is tax-exempt under section 501(c)(3) of the Code.

Public Charity

A 501(c)(3) organization with income generated from a broad base of support

from the public.

Qualifying Distributions

Any amount paid to accomplish religious, charitable, scientific, literary, or other

public purposes, usually in the form of a grant. Distributions by the private

foundation to a disqualified person with respect to the private foundation, or

to a non-operating private foundation are not considered a qualified

distribution.

Quid Pro Quo Contribution

Payment to a charity that is partly a contribution and partly a payment for

goods or services. If the contribution is in excess of $75, the charity must

provide the donor with a written statement that specifies the amount of the

payment, above the value of the goods and services provided, that can be

considered deductible as a contribution.

Quorum

The minimum number of voting members who must be present in a meeting

in order to conduct business. For the board of directors of a Washington

nonprofit corporation, this number may not be less than one-third of the total

number of directors.

RCW

The Revised Code of Washington, which codifies Washington State statutes.

Reasonable Accommodation

The Americans with Disabilities Act (ADA) requires all employers to provide

“reasonable accommodation” to enable employees with disabilities to have

WASHINGTON NONPROFIT HANDBOOK -313- 2018