Page 130 - RFHL ANNUAL REPORT 2024_ONLINE

P. 130

128 Notes to the Consolidated Financial Statements

For the Year Ended September 30, 2024.

Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

4. Advances (continued)

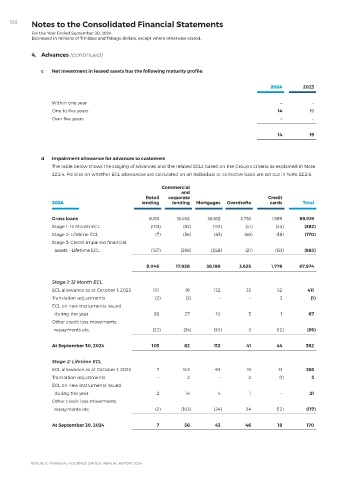

c Net investment in leased assets has the following maturity profile:

2024 2023

Within one year – –

One to five years 14 19

Over five years – –

14 19

d Impairment allowance for advances to customers

The table below shows the staging of advances and the related ECLs based on the Group’s criteria as explained in Note

22.2.4. Policies on whether ECL allowances are calculated on an individual or collective basis are set out in Note 22.2.6.

Commercial

and

Retail corporate Credit

2024 lending lending Mortgages Overdrafts cards Total

Gross loans 8,313 18,462 36,612 3,733 1,989 69,109

Stage 1: 12 Month ECL (103) (82) (112) (41) (44) (382)

Stage 2: Lifetime ECL (7) (56) (43) (46) (18) (170)

Stage 3: Credit-impaired financial

assets - Lifetime ECL (157) (396) (258) (21) (151) (983)

8,046 17,928 36,199 3,625 1,776 67,574

Stage 1: 12 Month ECL

ECL allowance as at October 1, 2023 101 91 132 35 52 411

Translation adjustments (2) (2) – – 3 (1)

ECL on new instruments issued

during the year 26 27 10 3 1 67

Other credit loss movements,

repayments etc. (22) (34) (30) 3 (12) (95)

At September 30, 2024 103 82 112 41 44 382

Stage 2: Lifetime ECL

ECL allowance as at October 1, 2023 7 143 63 19 31 263

Translation adjustments – 2 – 2 (1) 3

ECL on new instruments issued

during the year 2 14 4 1 – 21

Other credit loss movements,

repayments etc. (2) (103) (24) 24 (12) (117)

At September 30, 2024 7 56 43 46 18 170