Page 131 - RFHL ANNUAL REPORT 2024_ONLINE

P. 131

129

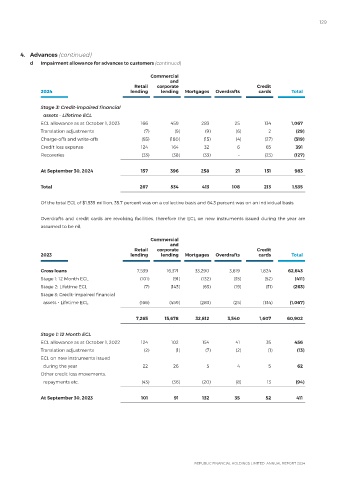

4. Advances (continued)

d Impairment allowance for advances to customers (continued)

Commercial

and

Retail corporate Credit

2024 lending lending Mortgages Overdrafts cards Total

Stage 3: Credit-impaired financial

assets - Lifetime ECL

ECL allowance as at October 1, 2023 166 459 283 25 134 1,067

Translation adjustments (7) (9) (9) (6) 2 (29)

Charge-offs and write-offs (93) (180) (15) (4) (27) (319)

Credit loss expense 124 164 32 6 65 391

Recoveries (33) (38) (33) – (23) (127)

At September 30, 2024 157 396 258 21 151 983

Total 267 534 413 108 213 1,535

Of the total ECL of $1,535 million, 35.7 percent was on a collective basis and 64.3 percent was on an individual basis.

Overdrafts and credit cards are revolving facilities, therefore the ECL on new instruments issued during the year are

assumed to be nil.

Commercial

and

Retail corporate Credit

2023 lending lending Mortgages Overdrafts cards Total

Gross loans 7,539 16,371 33,290 3,619 1,824 62,643

Stage 1: 12 Month ECL (101) (91) (132) (35) (52) (411)

Stage 2: Lifetime ECL (7) (143) (63) (19) (31) (263)

Stage 3: Credit-impaired financial

assets - Lifetime ECL (166) (459) (283) (25) (134) (1,067)

7,265 15,678 32,812 3,540 1,607 60,902

Stage 1: 12 Month ECL

ECL allowance as at October 1, 2022 124 102 154 41 35 456

Translation adjustments (2) (1) (7) (2) (1) (13)

ECL on new instruments issued

during the year 22 26 5 4 5 62

Other credit loss movements,

repayments etc. (43) (36) (20) (8) 13 (94)

At September 30, 2023 101 91 132 35 52 411