Page 132 - RFHL ANNUAL REPORT 2024_ONLINE

P. 132

130 Notes to the Consolidated Financial Statements

For the Year Ended September 30, 2024.

Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

4. Advances (continued)

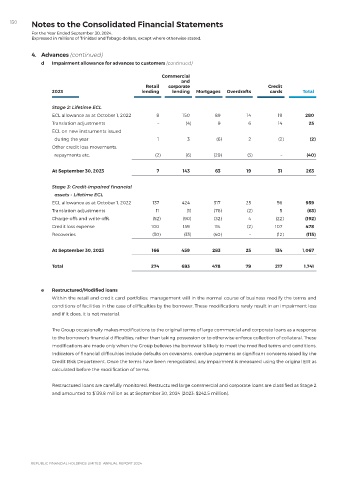

d Impairment allowance for advances to customers (continued)

Commercial

and

Retail corporate Credit

2023 lending lending Mortgages Overdrafts cards Total

Stage 2: Lifetime ECL

ECL allowance as at October 1, 2022 8 150 89 14 19 280

Translation adjustments – (4) 9 6 14 25

ECL on new instruments issued

during the year 1 3 (6) 2 (2) (2)

Other credit loss movements,

repayments etc. (2) (6) (29) (3) – (40)

At September 30, 2023 7 143 63 19 31 263

Stage 3: Credit-impaired financial

assets - Lifetime ECL

ECL allowance as at October 1, 2022 137 424 317 25 56 959

Translation adjustments 11 (1) (76) (2) 5 (63)

Charge-offs and write-offs (52) (90) (32) 4 (22) (192)

Credit loss expense 100 159 114 (2) 107 478

Recoveries (30) (33) (40) – (12) (115)

At September 30, 2023 166 459 283 25 134 1,067

Total 274 693 478 79 217 1,741

e Restructured/Modified loans

Within the retail and credit card portfolios, management will in the normal course of business modify the terms and

conditions of facilities in the case of difficulties by the borrower. These modifications rarely result in an impairment loss

and if it does, it is not material.

The Group occasionally makes modifications to the original terms of large commercial and corporate loans as a response

to the borrower’s financial difficulties, rather than taking possession or to otherwise enforce collection of collateral. These

modifications are made only when the Group believes the borrower is likely to meet the modified terms and conditions.

Indicators of financial difficulties include defaults on covenants, overdue payments or significant concerns raised by the

Credit Risk Department. Once the terms have been renegotiated, any impairment is measured using the original EIR as

calculated before the modification of terms.

Restructured loans are carefully monitored. Restructured large commercial and corporate loans are classified as Stage 2

and amounted to $139.8 million as at September 30, 2024 (2023: $242.5 million).