Page 155 - RFHL ANNUAL REPORT 2024_ONLINE

P. 155

153

22. Risk management (continued)

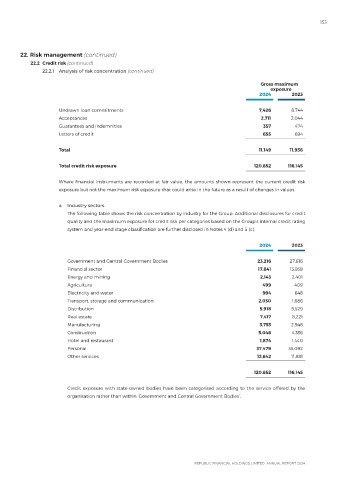

22.2 Credit risk (continued)

22.2.1 Analysis of risk concentration (continued)

Gross maximum

exposure

2024 2023

Undrawn loan commitments 7,426 8,744

Acceptances 2,711 2,044

Guarantees and indemnities 357 474

Letters of credit 655 694

Total 11,149 11,956

Total credit risk exposure 120,852 116,145

Where financial instruments are recorded at fair value, the amounts shown represent the current credit risk

exposure but not the maximum risk exposure that could arise in the future as a result of changes in values.

a Industry sectors

The following table shows the risk concentration by industry for the Group. Additional disclosures for credit

quality and the maximum exposure for credit risk per categories based on the Group’s internal credit rating

system and year-end stage classification are further disclosed in Notes 4 (d) and 5 (c).

2024 2023

Government and Central Government Bodies 23,216 27,616

Financial sector 17,841 13,938

Energy and mining 2,143 2,401

Agriculture 499 409

Electricity and water 994 648

Transport, storage and communication 2,030 1,686

Distribution 5,918 5,529

Real estate 7,417 8,221

Manufacturing 3,753 2,948

Construction 5,046 4,336

Hotel and restaurant 1,874 1,440

Personal 37,479 35,092

Other services 12,642 11,881

120,852 116,145

Credit exposure with state-owned bodies have been categorised according to the service offered by the

organisation rather than within ‘Government and Central Government Bodies’.