Page 160 - RFHL ANNUAL REPORT 2024_ONLINE

P. 160

158 Notes to the Consolidated Financial Statements

For the Year Ended September 30, 2024.

Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

22. Risk management (continued)

22.2 Credit risk (continued)

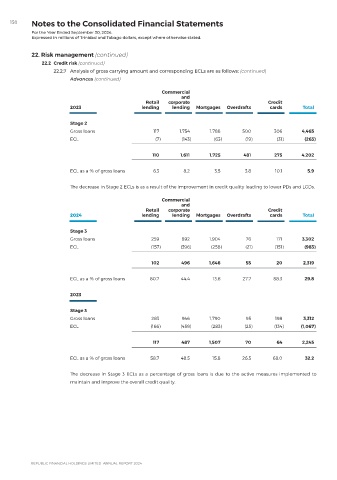

22.2.7 Analysis of gross carrying amount and corresponding ECLs are as follows: (continued)

Advances (continued)

Commercial

and

Retail corporate Credit

2023 lending lending Mortgages Overdrafts cards Total

Stage 2

Gross loans 117 1,754 1,788 500 306 4,465

ECL (7) (143) (63) (19) (31) (263)

110 1,611 1,725 481 275 4,202

ECL as a % of gross loans 6.3 8.2 3.5 3.8 10.1 5.9

The decrease in Stage 2 ECLs is as a result of the improvement in credit quality leading to lower PDs and LGDs.

Commercial

and

Retail corporate Credit

2024 lending lending Mortgages Overdrafts cards Total

Stage 3

Gross loans 259 892 1,904 76 171 3,302

ECL (157) (396) (258) (21) (151) (983)

102 496 1,646 55 20 2,319

ECL as a % of gross loans 60.7 44.4 13.6 27.7 88.3 29.8

2023

Stage 3

Gross loans 283 946 1,790 95 198 3,312

ECL (166) (459) (283) (25) (134) (1,067)

117 487 1,507 70 64 2,245

ECL as a % of gross loans 58.7 48.5 15.8 26.5 68.0 32.2

The decrease in Stage 3 ECLs as a percentage of gross loans is due to the active measures implemented to

maintain and improve the overall credit quality.