Page 163 - RFHL ANNUAL REPORT 2024_ONLINE

P. 163

161

22. Risk management (continued)

22.3 Liquidity risk (continued)

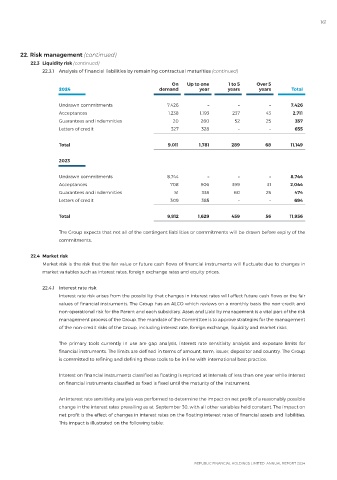

22.3.1 Analysis of financial liabilities by remaining contractual maturities (continued)

On Up to one 1 to 5 Over 5

2024 demand year years years Total

Undrawn commitments 7,426 – – – 7,426

Acceptances 1,238 1,193 237 43 2,711

Guarantees and indemnities 20 260 52 25 357

Letters of credit 327 328 – – 655

Total 9,011 1,781 289 68 11,149

2023

Undrawn commitments 8,744 – – – 8,744

Acceptances 708 906 399 31 2,044

Guarantees and indemnities 51 338 60 25 474

Letters of credit 309 385 – – 694

Total 9,812 1,629 459 56 11,956

The Group expects that not all of the contingent liabilities or commitments will be drawn before expiry of the

commitments.

22.4 Market risk

Market risk is the risk that the fair value or future cash flows of financial instruments will fluctuate due to changes in

market variables such as interest rates, foreign exchange rates and equity prices.

22.4.1 Interest rate risk

Interest rate risk arises from the possibility that changes in interest rates will affect future cash flows or the fair

values of financial instruments. The Group has an ALCO which reviews on a monthly basis the non-credit and

non-operational risk for the Parent and each subsidiary. Asset and Liability management is a vital part of the risk

management process of the Group. The mandate of the Committee is to approve strategies for the management

of the non-credit risks of the Group, including interest rate, foreign exchange, liquidity and market risks.

The primary tools currently in use are gap analysis, interest rate sensitivity analysis and exposure limits for

financial instruments. The limits are defined in terms of amount, term, issuer, depositor and country. The Group

is committed to refining and defining these tools to be in line with international best practice.

Interest on financial instruments classified as floating is repriced at intervals of less than one year while interest

on financial instruments classified as fixed is fixed until the maturity of the instrument.

An interest rate sensitivity analysis was performed to determine the impact on net profit of a reasonably possible

change in the interest rates prevailing as at September 30, with all other variables held constant. The impact on

net profit is the effect of changes in interest rates on the floating interest rates of financial assets and liabilities.

This impact is illustrated on the following table: