Page 164 - RFHL ANNUAL REPORT 2024_ONLINE

P. 164

162 Notes to the Consolidated Financial Statements

For the Year Ended September 30, 2024.

Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

22. Risk management (continued)

22.4 Market risk (continued)

22.4.1 Interest rate risk (continued)

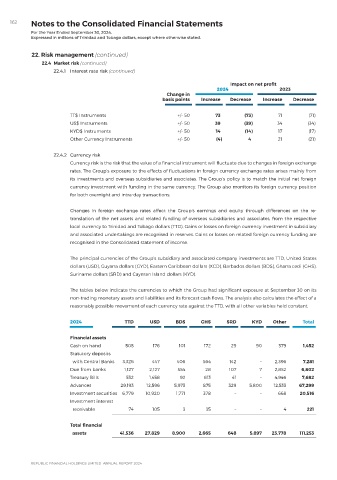

Impact on net profit

2024 2023

Change in

basis points Increase Decrease Increase Decrease

TT$ Instruments +/- 50 73 (73) 71 (71)

US$ Instruments +/- 50 39 (39) 34 (34)

KYD$ Instruments +/- 50 14 (14) 17 (17)

Other Currency Instruments +/- 50 (4) 4 21 (21)

22.4.2 Currency risk

Currency risk is the risk that the value of a financial instrument will fluctuate due to changes in foreign exchange

rates. The Group’s exposure to the effects of fluctuations in foreign currency exchange rates arises mainly from

its investments and overseas subsidiaries and associates. The Group’s policy is to match the initial net foreign

currency investment with funding in the same currency. The Group also monitors its foreign currency position

for both overnight and intra-day transactions.

Changes in foreign exchange rates affect the Group’s earnings and equity through differences on the re-

translation of the net assets and related funding of overseas subsidiaries and associates, from the respective

local currency to Trinidad and Tobago dollars (TTD). Gains or losses on foreign currency investment in subsidiary

and associated undertakings are recognised in reserves. Gains or losses on related foreign currency funding are

recognised in the Consolidated statement of income.

The principal currencies of the Group’s subsidiary and associated company investments are TTD, United States

dollars (USD), Guyana dollars (GYD), Eastern Caribbean dollars (XCD), Barbados dollars (BDS), Ghana cedi (GHS),

Suriname dollars (SRD) and Cayman Island dollars (KYD).

The tables below indicate the currencies to which the Group had significant exposure at September 30 on its

non-trading monetary assets and liabilities and its forecast cash flows. The analysis also calculates the effect of a

reasonably possible movement of each currency rate against the TTD, with all other variables held constant.

2024 TTD USD BDS GHS SRD KYD Other Total

Financial assets

Cash on hand 505 176 101 172 29 90 379 1,452

Statutory deposits

with Central Banks 3,326 447 406 564 142 – 2,396 7,281

Due from banks 1,127 2,127 554 28 107 7 2,852 6,802

Treasury Bills 532 1,458 92 613 41 – 4,946 7,682

Advances 29,193 12,596 5,973 875 329 5,800 12,533 67,299

Investment securities 6,779 10,920 1,771 378 – – 668 20,516

Investment interest

receivable 74 105 3 35 – – 4 221

Total financial

assets 41,536 27,829 8,900 2,665 648 5,897 23,778 111,253