Page 169 - RFHL ANNUAL REPORT 2024_ONLINE

P. 169

167

24. Capital management (continued)

At September 30, 2024, RBL and each of RFHL’s banking subsidiaries exceeded the minimum levels required for adequately

capitalised financial institutions (2023: exceeded).

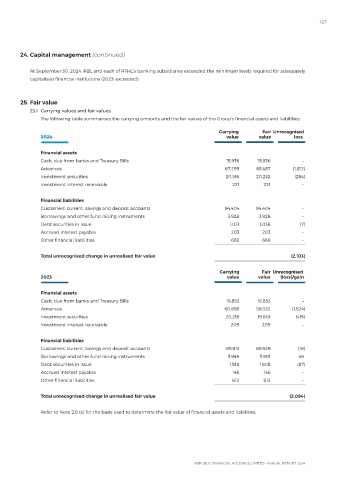

25. Fair value

25.1 Carrying values and fair values

The following table summarises the carrying amounts and the fair values of the Group’s financial assets and liabilities:

Carrying Fair Unrecognised

2024 value value loss

Financial assets

Cash, due from banks and Treasury Bills 15,936 15,936 –

Advances 67,299 65,487 (1,812)

Investment securities 20,516 20,232 (284)

Investment interest receivable 221 221 –

Financial liabilities

Customers’ current, savings and deposit accounts 94,404 94,404 –

Borrowings and other fund raising instruments 3,928 3,928 –

Debt securities in issue 1,031 1,038 (7)

Accrued interest payable 203 203 –

Other financial liabilities 666 666 –

Total unrecognised change in unrealised fair value (2,103)

Carrying Fair Unrecognised

2023 value value (loss)/gain

Financial assets

Cash, due from banks and Treasury Bills 16,853 16,853 –

Advances 60,656 59,032 (1,624)

Investment securities 20,216 19,801 (415)

Investment interest receivable 209 209 –

Financial liabilities

Customers’ current, savings and deposit accounts 89,913 89,929 (16)

Borrowings and other fund raising instruments 3,949 3,901 48

Debt securities in issue 1,518 1,605 (87)

Accrued interest payable 146 146 –

Other financial liabilities 612 612 –

Total unrecognised change in unrealised fair value (2,094)

Refer to Note 2.6 (x) for the basis used to determine the fair value of financial assets and liabilities.