Page 171 - RFHL ANNUAL REPORT 2024_ONLINE

P. 171

169

25. Fair value (continued)

25.2 Fair value and fair value hierarchies (continued)

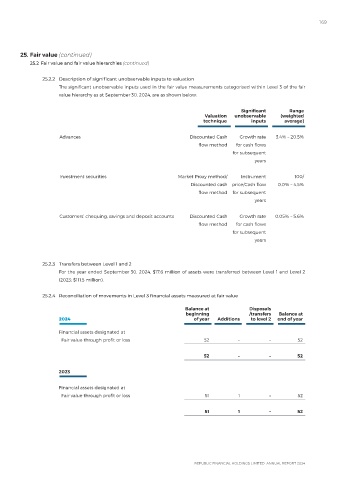

25.2.2 Description of significant unobservable inputs to valuation

The significant unobservable inputs used in the fair value measurements categorised within Level 3 of the fair

value hierarchy as at September 30, 2024, are as shown below:

Significant Range

Valuation unobservable (weighted

technique inputs average)

Advances Discounted Cash Growth rate 3.4% – 20.5%

flow method for cash flows

for subsequent

years

Investment securities Market Proxy method/ Instrument 100/

Discounted cash price/Cash flow 0.0% – 4.5%

flow method for subsequent

years

Customers’ chequing, savings and deposit accounts Discounted Cash Growth rate 0.05% – 5.6%

flow method for cash flows

for subsequent

years

25.2.3 Transfers between Level 1 and 2

For the year ended September 30, 2024, $17.6 million of assets were transferred between Level 1 and Level 2

(2023: $111.5 million).

25.2.4 Reconciliation of movements in Level 3 financial assets measured at fair value

Balance at Disposals

beginning /transfers Balance at

2024 of year Additions to level 2 end of year

Financial assets designated at

Fair value through profit or loss 52 – – 52

52 – – 52

2023

Financial assets designated at

Fair value through profit or loss 51 1 – 52

51 1 – 52