Page 170 - RFHL ANNUAL REPORT 2024_ONLINE

P. 170

168 Notes to the Consolidated Financial Statements

For the Year Ended September 30, 2024.

Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

25. Fair value (continued)

25.2 Fair value and fair value hierarchies

25.2.1 Determination of fair value and fair value hierarchies

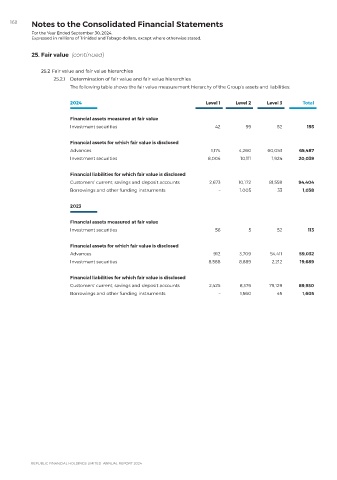

The following table shows the fair value measurement hierarchy of the Group’s assets and liabilities:

2024 Level 1 Level 2 Level 3 Total

Financial assets measured at fair value

Investment securities 42 99 52 193

Financial assets for which fair value is disclosed

Advances 1,174 4,260 60,053 65,487

Investment securities 8,004 10,111 1,924 20,039

Financial liabilities for which fair value is disclosed

Customers’ current, savings and deposit accounts 2,673 10,172 81,559 94,404

Borrowings and other funding instruments – 1,005 33 1,038

2023

Financial assets measured at fair value

Investment securities 56 5 52 113

Financial assets for which fair value is disclosed

Advances 912 3,709 54,411 59,032

Investment securities 8,588 8,889 2,212 19,689

Financial liabilities for which fair value is disclosed

Customers’ current, savings and deposit accounts 2,425 8,376 79,129 89,930

Borrowings and other funding instruments – 1,560 45 1,605