Page 166 - RFHL ANNUAL REPORT 2024_ONLINE

P. 166

164 Notes to the Consolidated Financial Statements

For the Year Ended September 30, 2024.

Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

22. Risk management (continued)

22.4 Market risk (continued)

22.4.2 Currency risk (continued)

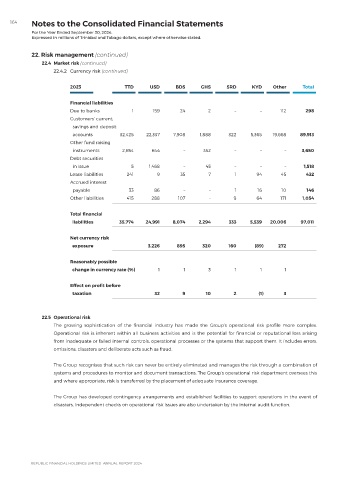

2023 TTD USD BDS GHS SRD KYD Other Total

Financial liabilities

Due to banks 1 159 24 2 – – 112 298

Customers’ current,

savings and deposit

accounts 32,425 22,337 7,908 1,888 322 5,365 19,668 89,913

Other fund raising

instruments 2,654 644 – 352 – – – 3,650

Debt securities

in issue 5 1,468 – 45 – – – 1,518

Lease liabilities 241 9 35 7 1 94 45 432

Accrued interest

payable 33 86 – – 1 16 10 146

Other liabilities 415 288 107 - 9 64 171 1,054

Total financial

liabilities 35,774 24,991 8,074 2,294 333 5,539 20,006 97,011

Net currency risk

exposure 3,226 895 320 160 (89) 272

Reasonably possible

change in currency rate (%) 1 1 3 1 1 1

Effect on profit before

taxation 32 9 10 2 (1) 3

22.5 Operational risk

The growing sophistication of the financial industry has made the Group’s operational risk profile more complex.

Operational risk is inherent within all business activities and is the potential for financial or reputational loss arising

from inadequate or failed internal controls, operational processes or the systems that support them. It includes errors,

omissions, disasters and deliberate acts such as fraud.

The Group recognises that such risk can never be entirely eliminated and manages the risk through a combination of

systems and procedures to monitor and document transactions. The Group’s operational risk department oversees this

and where appropriate, risk is transferred by the placement of adequate insurance coverage.

The Group has developed contingency arrangements and established facilities to support operations in the event of

disasters. Independent checks on operational risk issues are also undertaken by the internal audit function.