Page 162 - RFHL ANNUAL REPORT 2024_ONLINE

P. 162

160 Notes to the Consolidated Financial Statements

For the Year Ended September 30, 2024.

Expressed in millions of Trinidad and Tobago dollars, except where otherwise stated.

22. Risk management (continued)

22.3 Liquidity risk (continued)

The Asset/Liability Committee (ALCO) sets targets for daily float, allowable liquid assets and funding diversification in

line with system liquidity trends. While the primary asset used for short-term liquidity management is the Treasury Bill,

the Group also holds significant investments in other Government securities, which can be used for liquidity support.

The Group continually balances the need for short-term assets, which have lower yields, with the need for higher asset

returns.

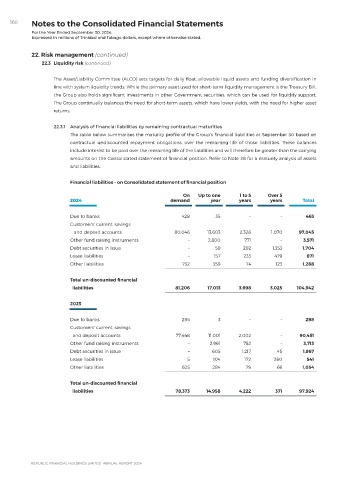

22.3.1 Analysis of financial liabilities by remaining contractual maturities

The table below summarises the maturity profile of the Group’s financial liabilities at September 30 based on

contractual undiscounted repayment obligations, over the remaining life of those liabilities. These balances

include interest to be paid over the remaining life of the liabilities and will therefore be greater than the carrying

amounts on the Consolidated statement of financial position. Refer to Note 28 for a maturity analysis of assets

and liabilities.

Financial liabilities - on Consolidated statement of financial position

On Up to one 1 to 5 Over 5

2024 demand year years years Total

Due to banks 428 35 – – 463

Customers’ current, savings

and deposit accounts 80,046 13,603 2,326 1,070 97,045

Other fund raising instruments – 2,800 771 – 3,571

Debt securities in issue – 59 292 1,353 1,704

Lease liabilities – 157 235 479 871

Other liabilities 732 359 74 123 1,288

Total un-discounted financial

liabilities 81,206 17,013 3,698 3,025 104,942

2023

Due to banks 295 3 – – 298

Customers’ current, savings

and deposit accounts 77,448 11,001 2,002 – 90,451

Other fund raising instruments – 2,961 752 – 3,713

Debt securities in issue – 605 1,217 45 1,867

Lease liabilities 5 104 172 260 541

Other liabilities 625 284 79 66 1,054

Total un-discounted financial

liabilities 78,373 14,958 4,222 371 97,924