Page 159 - RFHL ANNUAL REPORT 2024_ONLINE

P. 159

157

22. Risk management (continued)

22.2 Credit risk (continued)

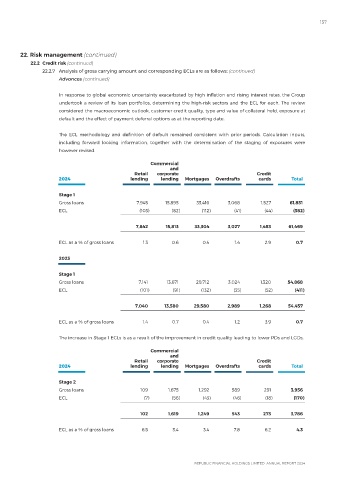

22.2.7 Analysis of gross carrying amount and corresponding ECLs are as follows: (continued)

Advances (continued)

In response to global economic uncertainty exacerbated by high inflation and rising interest rates, the Group

undertook a review of its loan portfolios, determining the high-risk sectors and the ECL for each. The review

considered the macroeconomic outlook, customer credit quality, type and value of collateral held, exposure at

default and the effect of payment deferral options as at the reporting date.

The ECL methodology and definition of default remained consistent with prior periods. Calculation inputs,

including forward looking information, together with the determination of the staging of exposures were

however revised.

Commercial

and

Retail corporate Credit

2024 lending lending Mortgages Overdrafts cards Total

Stage 1

Gross loans 7,945 15,895 33,416 3,068 1,527 61,851

ECL (103) (82) (112) (41) (44) (382)

7,842 15,813 33,304 3,027 1,483 61,469

ECL as a % of gross loans 1.3 0.6 0.4 1.4 2.9 0.7

2023

Stage 1

Gross loans 7,141 13,671 29,712 3,024 1,320 54,868

ECL (101) (91) (132) (35) (52) (411)

7,040 13,580 29,580 2,989 1,268 54,457

ECL as a % of gross loans 1.4 0.7 0.4 1.2 3.9 0.7

The increase in Stage 1 ECLs is as a result of the improvement in credit quality leading to lower PDs and LGDs.

Commercial

and

Retail corporate Credit

2024 lending lending Mortgages Overdrafts cards Total

Stage 2

Gross loans 109 1,675 1,292 589 291 3,956

ECL (7) (56) (43) (46) (18) (170)

102 1,619 1,249 543 273 3,786

ECL as a % of gross loans 6.5 3.4 3.4 7.8 6.2 4.3