Page 31 - RFHL ANNUAL REPORT 2024_ONLINE

P. 31

29

Average total assets increased by $3.8 billion or 3.4 percent in the fiscal, with the net interest margin increasing from 4.17 percent

in 2023 to 4.38 percent in 2024.

• In Trinidad and Tobago, Net interest income grew by $208 million, being the net impact of increases in Interest income and

interest expense of $283 million and $75 million respectively. The increase in Interest income was generated primarily from the

growth in the advances portfolio, coupled with the continued higher interest rates on US-dollar denominated investments in

the earlier part of the year.

The $75 million increase in interest expense mainly stemmed from higher interest rates on the Bank’s US$150 million debt. Due

to the increasing interest rates, a strategic decision was made to repay this bond in June 2024.

• In Guyana, Net interest income rose by $66 million, driven by a $68 million increase in Interest income and a $2 million rise in

interest expense. These changes were mainly attributed to growth in advances, investment securities, and liquid assets, while

a higher deposit portfolio led to increased interest expenses.

• Our operations in the Cayman Islands reported a $16 million reduction in Net interest income, driven by a $106 million increase

in Interest income and a $122 million rise in interest expense. The increased Interest income was due to higher yields on US-

dollar investment securities, while the increased interest expense stemmed from increased interest rates on customer deposits

in the Cayman market and a growing deposit portfolio.

• The subsidiaries in the Eastern Caribbean (EC) recorded growth in Net interest income by $70 million due to increases in

Interest income and interest expense by $80 million and $10 million respectively. This resulted from higher portfolio balances

for advances and customer deposits in the EC islands, while interest rates remained fairly constant.

• In Suriname, the increase of $45 million was mainly due to higher Interest income, which was attributable to growth in the

advances and Treasury Bill portfolios.

• In the British Virgin Islands the change of $13 million in Net interest income was due to increased Interest income and

interest expense by $25 million and $12 million respectively. Increased yields on advances, investments and customer deposits

accounted for the increased income and expense.

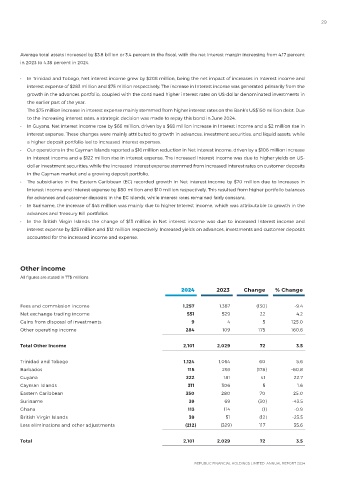

Other income

All figures are stated in TT$ millions

2024 2023 Change % Change

Fees and commission income 1,257 1,387 (130) -9.4

Net exchange trading income 551 529 22 4.2

Gains from disposal of investments 9 4 5 125.0

Other operating income 284 109 175 160.6

Total Other Income 2,101 2,029 72 3.5

Trinidad and Tobago 1,124 1,064 60 5.6

Barbados 115 293 (178) -60.8

Guyana 222 181 41 22.7

Cayman Islands 311 306 5 1.6

Eastern Caribbean 350 280 70 25.0

Suriname 39 69 (30) -43.5

Ghana 113 114 (1) -0.9

British Virgin Islands 39 51 (12) -23.5

Less eliminations and other adjustments (212) (329) 117 35.6

Total 2,101 2,029 72 3.5