Page 34 - RFHL ANNUAL REPORT 2024_ONLINE

P. 34

32 Group President and CEO’s Discussion and Analysis continued

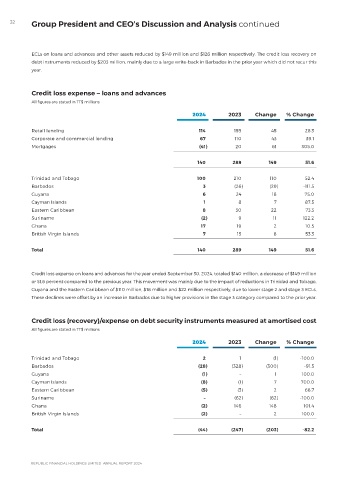

ECLs on loans and advances and other assets reduced by $149 million and $126 million respectively. The credit loss recovery on

debt instruments reduced by $203 million, mainly due to a large write-back in Barbados in the prior year which did not recur this

year.

Credit loss expense – loans and advances

All figures are stated in TT$ millions

2024 2023 Change % Change

Retail lending 114 159 45 28.3

Corporate and commercial lending 67 110 43 39.1

Mortgages (41) 20 61 305.0

140 289 149 51.6

Trinidad and Tobago 100 210 110 52.4

Barbados 3 (26) (29) -111.5

Guyana 6 24 18 75.0

Cayman Islands 1 8 7 87.5

Eastern Caribbean 8 30 22 73.3

Suriname (2) 9 11 122.2

Ghana 17 19 2 10.5

British Virgin Islands 7 15 8 53.3

Total 140 289 149 51.6

Credit loss expense on loans and advances for the year ended September 30, 2024, totaled $140 million, a decrease of $149 million

or 51.6 percent compared to the previous year. This movement was mainly due to the impact of reductions in Trinidad and Tobago,

Guyana and the Eastern Caribbean of $110 million, $18 million and $22 million respectively, due to lower stage 2 and stage 3 ECLs.

These declines were offset by an increase in Barbados due to higher provisions in the stage 3 category compared to the prior year.

Credit loss (recovery)/expense on debt security instruments measured at amortised cost

All figures are stated in TT$ millions

2024 2023 Change % Change

Trinidad and Tobago 2 1 (1) -100.0

Barbados (28) (328) (300) -91.5

Guyana (1) – 1 100.0

Cayman Islands (8) (1) 7 700.0

Eastern Caribbean (5) (3) 2 66.7

Suriname – (62) (62) -100.0

Ghana (2) 146 148 101.4

British Virgin Islands (2) – 2 100.0

Total (44) (247) (203) -82.2