Page 37 - RFHL ANNUAL REPORT 2024_ONLINE

P. 37

35

• In Trinidad and Tobago, total advances increased by $4.0 billion or 13.3 percent. This growth was experienced across all portfolios.

• In Barbados, total advances increased by $363 million or 6.5 percent, reflective of growth in the corporate and commercial and

mortgages portfolios.

• In Guyana and Cayman Islands, total advances increased by $545 million or 14.8 percent and $760 million or 10.0 percent

respectively, reflective of growth across all segments.

• The Eastern Caribbean increased by $752 million or 8.0 percent mainly through growth in the retail, mortgage and credit card

portfolios.

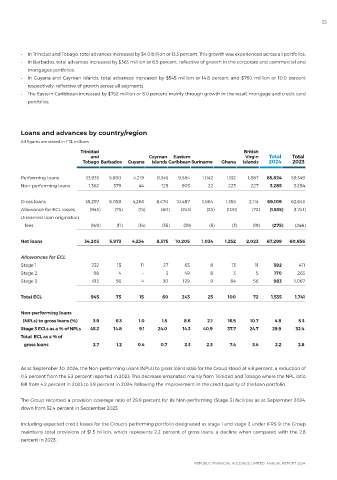

Loans and advances by country/region

All figures are stated in TT$ millions

Trinidad British

and Cayman Eastern Virgin Total Total

Tobago Barbados Guyana Islands Caribbean Suriname Ghana Islands 2024 2023

Performing loans 33,935 5,680 4,219 8,345 9,584 1,042 1,132 1,887 65,824 59,349

Non-performing loans 1,362 379 44 125 903 22 223 227 3,285 3,294

Gross loans 35,297 6,059 4,263 8,470 10,487 1,064 1,355 2,114 69,109 62,643

Allowance for ECL losses (945) (75) (15) (60) (243) (25) (100) (72) (1,535) (1,741)

Unearned loan origination

fees (149) (11) (14) (35) (39) (5) (3) (19) (275) (246)

Net loans 34,203 5,973 4,234 8,375 10,205 1,034 1,252 2,023 67,299 60,656

Allowances for ECL

Stage 1 232 15 11 27 65 8 13 11 382 411

Stage 2 98 4 – 3 49 8 3 5 170 263

Stage 3 615 56 4 30 129 9 84 56 983 1,067

Total ECL 945 75 15 60 243 25 100 72 1,535 1,741

Non-performing loans

(NPLs) to gross loans (%) 3.9 6.3 1.0 1.5 8.6 2.1 16.5 10.7 4.8 5.3

Stage 3 ECLs as a % of NPLs 45.2 14.8 9.1 24.0 14.3 40.9 37.7 24.7 29.9 32.4

Total ECL as a % of

gross loans 2.7 1.2 0.4 0.7 2.3 2.3 7.4 3.4 2.2 2.8

As at September 30, 2024, the Non-performing Loans (NPLs) to gross loans ratio for the Group stood at 4.8 percent, a reduction of

0.5 percent from the 5.3 percent reported in 2023. This decrease emanated mainly from Trinidad and Tobago where the NPL ratio

fell from 4.2 percent in 2023 to 3.9 percent in 2024, following the improvement in the credit quality of the loan portfolio.

The Group recorded a provision coverage ratio of 29.9 percent for its Non-performing (Stage 3) facilities as at September 2024,

down from 32.4 percent in September 2023.

Including expected credit losses for the Group’s performing portfolio designated as stage 1 and stage 2 under IFRS 9, the Group

maintains total provisions of $1.5 billion, which represents 2.2 percent of gross loans, a decline when compared with the 2.8

percent in 2023.