Page 35 - RFHL ANNUAL REPORT 2024_ONLINE

P. 35

33

For the year ended September 30, 2024, the Group experienced a net recovery of $44 million in credit losses on debt security

instruments measured at amortised cost. This represents a decrease in recoveries of $203 million or 82.2 percent when compared

to the previous year.

The decrease in Barbados was primarily due to a one-time write-back on government debt in the prior year, which did not recur

in 2024. Similarly, the decline in Ghana was a result of a significant ECL related to the restructuring of the Government of Ghana’s

debt in 2023, which did not occur in 2024.

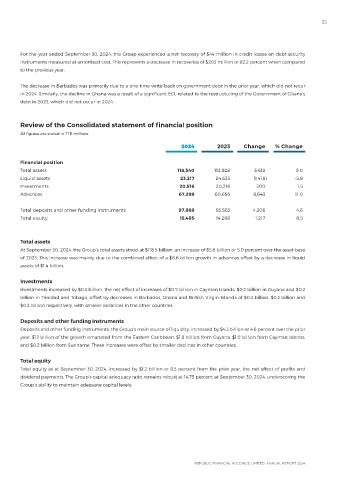

Review of the Consolidated statement of financial position

All figures are stated in TT$ millions

2024 2023 Change % Change

Financial position

Total assets 118,540 112,928 5,612 5.0

Liquid assets 23,217 24,635 (1,418) -5.8

Investments 20,516 20,216 300 1.5

Advances 67,299 60,656 6,643 11.0

Total deposits and other funding instruments 97,869 93,563 4,306 4.6

Total equity 15,485 14,268 1,217 8.5

Total assets

At September 30, 2024, the Group’s total assets stood at $118.5 billion, an increase of $5.6 billion or 5.0 percent over the asset base

of 2023. This increase was mainly due to the combined effect of a $6.6 billion growth in advances offset by a decrease in liquid

assets of $1.4 billion.

Investments

Investments increased by $0.3 billion, the net effect of increases of $0.7 billion in Cayman Islands, $0.2 billion in Guyana and $0.2

billion in Trinidad and Tobago, offset by decreases in Barbados, Ghana and British Virgin Islands of $0.3 billion, $0.3 billion and

$0.2 billion respectively, with smaller variances in the other countries.

Deposits and other funding instruments

Deposits and other funding instruments, the Group’s main source of liquidity, increased by $4.3 billion or 4.6 percent over the prior

year. $1.1 billion of the growth emanated from the Eastern Caribbean, $1.8 billion from Guyana, $1.0 billion from Cayman Islands,

and $0.2 billion from Suriname. These increases were offset by smaller declines in other countries.

Total equity

Total equity as at September 30, 2024, increased by $1.2 billion or 8.5 percent from the prior year, the net effect of profits and

dividend payments. The Group’s capital adequacy ratio remains robust at 14.75 percent at September 30, 2024, underscoring the

Group’s ability to maintain adequate capital levels.