Page 33 - RFHL ANNUAL REPORT 2024_ONLINE

P. 33

31

• In Trinidad and Tobago there was an increase of $98.8 million, primarily driven by higher credit card expenses and higher IT

costs as the Bank continues to focus on our digitisation strategy.

• A $26 million decrease was recorded in Suriname, mainly due to the appreciation of the Surinamese dollar.

• In Guyana and BVI, expenses decreased by $3.7 million and $13.3 million respectively due to the prudent management of

expenses during the year.

• Depreciation increased by $45 million due to the impact of capitalisation of computer hardware and software, and properties

in Trinidad and Tobago, with smaller increases seen across the Group.

• The $23 million increase in advertising and public relations was mainly due to increased spend to raise the awareness of the

Republic Brand across the region.

• Other expenses mainly decreased due to the impairment of goodwill in Ghana of $117 million in 2023 which did not recur in

2024.

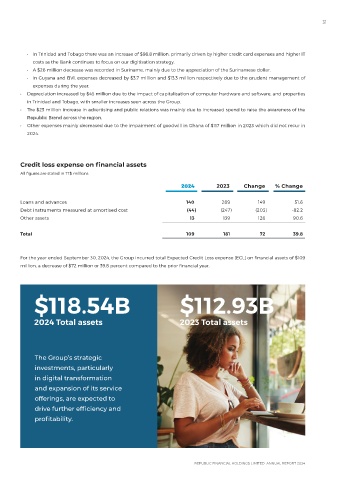

Credit loss expense on financial assets

All figures are stated in TT$ millions

2024 2023 Change % Change

Loans and advances 140 289 149 51.6

Debt instruments measured at amortised cost (44) (247) (203) -82.2

Other assets 13 139 126 90.6

Total 109 181 72 39.8

For the year ended September 30, 2024, the Group incurred total Expected Credit Loss expense (ECL) on financial assets of $109

million, a decrease of $72 million or 39.8 percent compared to the prior financial year.

$118.54B $112.93B

2024 Total assets 2023 Total assets

The Group’s strategic

investments, particularly

in digital transformation

and expansion of its service

offerings, are expected to

drive further efficiency and

profitability.