Page 2 - Bloomberg Businessweek - November 19, 2018

P. 2

Bloomberg Businessweek The Year Ahead 2019 50 Companies to Watch

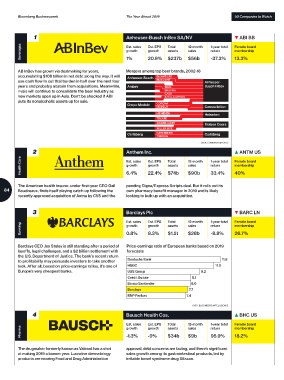

1 Anheuser-Busch InBev SA/NV ▼ ABI BB

Beverages Est. sales 20.9% Total 12-month 1-year total Female board

Est. EPS

sales

membership

growth

return

growth

assets

13.3%

$237b

-37.3%

1%

$56b

AB InBev has grown via dealmaking for years, Mergers among top beer brands, 2002-18

accumulating $108 billion in net debt along the way. It will Anheuser-Busch BUDWEISER

use cash flow to cut that burden in half over the next four BUD LIGHT Anheuser-

years and probably abstain from acquisitions. Meanwhile, Ambev SKOL Busch InBev

rivals will continue to consolidate the beer industry as BRAHMA

CASS

new markets open up in Asia. Don’t be shocked if ABI STELLA ARTOIS

puts its nonalcoholic assets up for sale.

Grupo Modelo CORONA

MODELO Constellation

HEINEKEN Heineken

TECATE

COORS LIGHT Molson Coors

MILLER LITE

Carlsberg CARLSBERG Carlsberg

TUBORG

DATA: COMPANY REPORTS

2 Anthem Inc. ▲ ANTM US

Health Care Est. sales 22.4% Total 12-month 1-year total Female board

Est. EPS

return

sales

membership

growth

growth

assets

$90b

40%

$74b

33.4%

6.4%

The American health insurer, under first-year CEO Gail pending Cigna/Express Scripts deal. But it rolls out its

84 Boudreaux, finds itself playing catch-up following the own pharmacy benefit manager in 2019 and is likely

recently approved acquisition of Aetna by CVS and the looking to bulk up with an acquisition.

3 Barclays Plc ▼ BARC LN

Est. sales Est. EPS Total 12-month 1-year total Female board

Banking growth 8.3% assets sales return membership

growth

26.7%

$28b

$1.5t

-8.8%

0.8%

Barclays CEO Jes Staley is still standing after a period of Price-earnings ratio of European banks based on 2019

layoffs, legal challenges, and a $2 billion settlement with forecasts

the U.S. Department of Justice. The bank’s recent return

to profitability may persuade investors to take another Deutsche Bank 11.8

look. After all, based on price-earnings ratios, it’s one of HSBC 11.0

Europe’s very cheapest banks. UBS Group 9.2

Credit Suisse 8.1

Banco Santander 8.0

Barclays 7.7

BNP Paribas 7.4

DATA: BLOOMBERG INTELLIGENCE

4 Bausch Health Cos. ▲ BHC US

Est. sales Est. EPS Total 12-month 1-year total Female board

Pharma growth -9% assets sales return membership

growth

$9b

18.2%

-1.3%

$34b

95.9%

The drugmaker formerly known as Valeant has a shot approval, debt concerns are fading, and there’s significant

at making 2019 a banner year. Lucrative dermatology sales growth among its gastrointestinal products, led by

products are nearing Food and Drug Administration irritable bowel syndrome drug Xifaxan.