Page 4 - Bloomberg Businessweek - November 19, 2018

P. 4

Bloomberg Businessweek The Year Ahead 2019 50 Companies to Watch

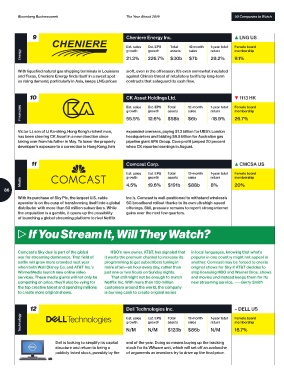

9 Cheniere Energy Inc. ▲ LNG US

Est. sales Est. EPS Total 12-month 1-year total Female board

sales

return

growth

assets

growth

membership

Energy 21.3% 226.7% $30b $7b 29.2% 9.1%

With liquefied natural gas shipping terminals in Louisiana aloft, even in the offseason. It’s even somewhat insulated

and Texas, Cheniere Energy finds itself in a sweet spot against China’s threat of retaliatory tariffs by long-term

as rising demand, particularly in Asia, keeps LNG prices contracts that safeguard its cash flow.

10 CK Asset Holdings Ltd. ▼ 1113 HK

Financials Est. sales 12.6% Total 12-month 1-year total Female board

Est. EPS

membership

growth

return

assets

growth

sales

26.7%

$6b

-18.9%

55.5%

$58b

Victor Li, son of Li Ka-shing, Hong Kong’s richest man, expanded overseas, paying $1.3 billion for UBS’s London

has been steering CK Asset in a new direction since headquarters and bidding $9.5 billion for Australian gas

taking over from his father in May. To lower the property pipeline giant APA Group. Core profit jumped 20 percent

developer’s exposure to a correction in Hong Kong, he’s when CK reported earnings in August.

11 Comcast Corp. ▲ CMCSA US

Est. sales Est. EPS Total 12-month 1-year total Female board

growth growth assets sales return membership

Media 4.5% 19.6% $191b $88b 8% 20%

86

With its purchase of Sky Plc, the largest U.S. cable Inc.’s. Comcast is well-positioned to withstand wireless’s

operator is on the cusp of transforming itself into a global 5G broadband rollout thanks to its own ultrahigh-speed

distributor with more than 50 million subscribers. While offerings. Still, pressure remains to report strong internet

the acquisition is a gamble, it opens up the possibility gains over the next few quarters.

of launching a global streaming platform to rival Netflix

▷ If You Stream It, Will They Watch?

Comcast’s Sky deal is part of the global HBO’s new owner, AT&T, has signaled that in local languages, knowing that what’s

war for streaming dominance. That field of it wants the premium channel to increase its popular in one country might not appeal in

battle will grow more crowded next year programming to get subscribers tuning in another. Comcast may be forced to create

when both Walt Disney Co. and AT&T Inc.’s more often—an hour every day, rather than original shows for Sky if AT&T decides to

WarnerMedia launch new online video just one or two hours on Sunday nights. stop licensing HBO and Warner Bros. shows

services. These media giants will not only be That still might not be enough to match and movies and instead keeps them for its

competing on price, they’ll also be vying for Netflix Inc. With more than 130 million new streaming service. ——Gerry Smith

the top creative talent and spending millions customers around the world, the company

to create more original shows. is burning cash to create original series

12 Dell Technologies Inc. – DELL US

Technology Est. sales N/M Total 12-month 1-year total Female board

Est. EPS

membership

return

assets

growth

growth

sales

N/M

N/M

$123b

16.7%

$86b

Dell is looking to simplify its capital end of the year. Doing so means buying up the tracking

structure and return to being a stock for its VMware unit, which will set off an avalanche

publicly listed stock, possibly by the of arguments as investors try to drive up the final price.