Page 3 - Bloomberg Businessweek - November 19, 2018

P. 3

Bloomberg Businessweek The Year Ahead 2019 50 Companies to Watch

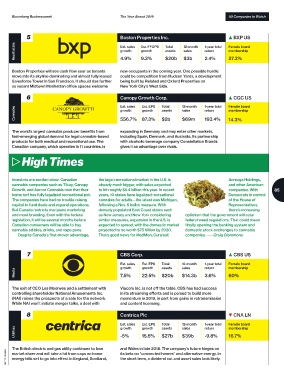

5 Boston Properties Inc. ▲ BXP US

Real Estate Est. sales Est. FFOPS Total 12-month 1-year total Female board

membership

return

assets

growth

sales

growth

27.3%

2.4%

$3b

4.9%

9.3%

$20b

Boston Properties will see cash flow soar as tenants new occupants in the coming year. One possible hurdle

move into its skyline-dominating and almost fully leased could be competition from Hudson Yards, a development

Salesforce Tower in San Francisco. It should rise further being built by Related and Oxford Properties on

as vacant Midtown Manhattan office spaces welcome New York City’s West Side.

6 Canopy Growth Corp. ▲ CGC US

Cannabis Est. sales Est. EPS Total 12-month 1-year total Female board

growth

return

assets

sales

growth

membership

$2b

87.3%

556.7%

193.4%

$69m

14.3%

The world’s largest cannabis producer benefits from expanding in Germany and may enter other markets,

fast-emerging global demand for legal cannabis-based including Spain, Denmark, and Australia. Its partnership

products for both medical and recreational use. The with alcoholic beverage company Constellation Brands

Canadian company, which operates in 11 countries, is gives it an advantage over rivals.

▷ High Times

Investors are excited about Canadian the legal recreational market in the U.S. is Acreage Holdings,

cannabis companies such as Tilray, Canopy already much bigger, with sales expected and other American

Growth, and Aurora Cannabis now that their to hit roughly $5.4 billion this year. In recent companies. With 85

home turf has fully legalized recreational pot. years, 10 states have legalized recreational Democrats in control

The companies have had no trouble raising cannabis for adults—the latest was Michigan, of the House of

capital to fund deals and expand operations. following a Nov. 6 ballot measure. With Representatives,

But Canada restricts marijuana marketing densely populated East Coast states such there’s increasing

and most branding. Even with the federal as New Jersey and New York considering optimism that the government will ease

legislation, it will be several months before similar measures, expansion in the U.S. is federal weed regulations. That could mean

Canadian consumers will be able to buy expected to spread, with the domestic market finally opening the banking system and

cannabis edibles, drinks, and vape pens. projected to be worth $75 billion by 2030. domestic stock exchanges to cannabis

Despite Canada’s first-mover advantage, That’s good news for MedMen, Curaleaf, companies. ——Craig Giammona

7 CBS Corp. ▲ CBS US

Est. sales Est. EPS Total 12-month 1-year total Female board

growth growth assets sales return membership

Media 7.5% 22.5% $20b $14.3b 3.6% 60%

The exit of CEO Les Moonves and a settlement with Viacom Inc. is not off the table. CBS has had success

controlling shareholder National Amusements Inc. in its streaming efforts and is poised to build more

(NAI) raises the prospects of a sale for the network. momentum in 2019, in part from gains in retransmission

While NAI won’t initiate merger talks, a deal with and content licensing.

8 Centrica Plc ▼ CNA LN

Est. sales Est. EPS Total 12-month 1-year total Female board

return

membership

assets

growth

growth

sales

Utilities -5% 15.5% $27b $39b -9.8% 16.7%

The British electric and gas utility continues to lose and Wales in late 2018. The company’s future hinges on

GETTY IMAGES market share and will take a hit from caps on home its bets on “connected homes” and alternative energy. In

energy bills set to go into effect in England, Scotland,

the short term, a dividend cut and asset sales look likely.