Page 7 - Bloomberg Businessweek - November 19, 2018

P. 7

Bloomberg Businessweek The Year Ahead 2019 50 Companies to Watch

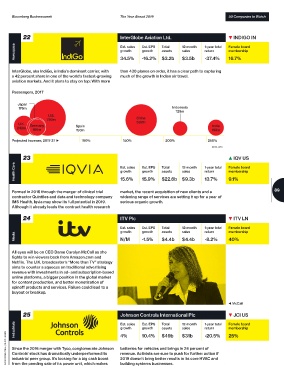

22 InterGlobe Aviation Ltd. ▼ INDIGO IN

Aerospace Est. sales -16.2% Total 12-month 1-year total Female board

Est. EPS

return

growth

sales

growth

assets

membership

$3.2b

-37.4%

16.7%

34.5%

$3.5b

InterGlobe, aka IndiGo, is India’s dominant carrier, with than 430 planes on order, it has a clear path to capturing

a 42 percent share in one of the world’s fastest-growing much of the growth in Indian air travel.

aviation markets. And it plans to stay on top: With more

Passengers, 2017

Japan

176m Indonesia

129m

U.S.

780m China

U.K. Germany 592m

India

242m 169m Spain 158m

193m

Projected increase, 2017-37 ▶ 100% 150% 200% 250%

DATA: IATA

23 Iqvia Holdings Inc. ▲ IQV US

Health Care Est. sales 15.9% Total 12-month 1-year total Female board

Est. EPS

growth

membership

return

growth

assets

sales

13.7%

9.1%

$22.6b

$9.3b

15.6%

Formed in 2016 through the merger of clinical trial market, the recent acquisition of new clients and a 89

contractor Quintiles and data and technology company widening range of services are setting it up for a year of

IMS Health, Iqvia may show its full potential in 2019. serious organic growth.

Although it already leads the contract health research

24 ITV Plc ▼ ITV LN

Est. sales Est. EPS Total 12-month 1-year total Female board

growth growth assets sales return membership

Media N/M -1.5% $4.4b $4.4b -8.2% 40%

All eyes will be on CEO Dame Carolyn McCall as she

fights to win viewers back from Amazon.com and

Netflix. The U.K. broadcaster’s “More than TV” strategy

aims to counter a squeeze on traditional advertising

revenue with investments in ad- and subscription-based

online platforms, a bigger position in the global market

for content production, and better monetization of

spinoff products and services. Failure could lead to a

buyout or breakup.

◀ McCall

25 Johnson Controls International Plc ▼ JCI US

Industrials Est. sales 10.4% Total 12-month 1-year total Female board

Est. EPS

growth

membership

growth

return

assets

sales

DARIO PIGNATELLI/BLOOMBERG Since the 2016 merger with Tyco, conglomerate Johnson batteries for vehicles and brings in 24 percent of

4%

-20.5%

$49b

$31b

25%

Controls’ stock has dramatically underperformed its

revenue. Activists are sure to push for further action if

2019 doesn’t bring better results in its core HVAC and

industrial peer group. It’s looking for a big cash boost

from the pending sale of its power unit, which makes

building systems businesses.