Page 5 - Bloomberg Businessweek - November 19, 2018

P. 5

Bloomberg Businessweek The Year Ahead 2019 50 Companies to Watch

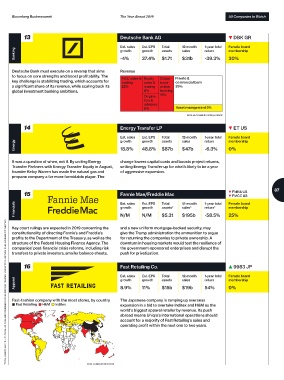

13 Deutsche Bank AG ▼ DBK GR

Est. sales Est. EPS Total 12-month 1-year total Female board

Banking growth 37.4% assets sales return membership

growth

$1.7t

-4%

30%

$31b

-39.3%

Deutsche Bank must execute on a revamp that aims Revenue

to focus on core strengths and boost profitability. The FICC sales & Equity Global Private &

key challenge is stabilizing trading, which accounts for trading sales & trans- commercial bank

a significant share of its revenue, while scaling back its 22% trading action 39%

global investment banking ambitions. 8% banking

Origina- 15%

tion &

advisory

8% Asset management 9%

DATA: BLOOMBERG INTELLIGENCE

14 Energy Transfer LP ▼ ET US

Est. sales Est. EPS Total 12-month 1-year total Female board

growth

membership

growth

return

sales

assets

Energy 18.8% 48.8% $87b $47b -6.3% 0%

It was a question of when, not if. By uniting Energy change lowers capital costs and boosts project returns,

Transfer Partners with Energy Transfer Equity in August, setting Energy Transfer up for what’s likely to be a year

founder Kelcy Warren has made the natural gas and of aggressive expansion.

propane company a far more formidable player. The

15 Fannie Mae/Freddie Mac ▼ FNMA US 87

▼ FMCC US

Financials Est. sales N/M Total 12-month 1-year total Female board

Est. EPS

assets*

growth

return*

sales*

membership

growth

25%

$5.3t

-58.5%

$195b

N/M

*TOTAL ASSETS AND 12-MONTH SALES DATA ARE COMBINED FANNIE/FREDDIE FIGURES; 1-YEAR TOTAL RETURN IS AN AVERAGE OF THE TWO.

Key court rulings are expected in 2019 concerning the and a new uniform mortgage-backed security, may

constitutionality of directing Fannie’s and Freddie’s give the Trump administration the ammunition to argue

profits to the Department of the Treasury, as well as the for returning the companies to private ownership. A

structure of the Federal Housing Finance Agency. The downturn in housing markets would test the resilience of

companies’ post-financial crisis reforms, including risk the government-sponsored enterprises and disrupt the

transfers to private investors, smaller balance sheets, push for privatization.

16 Fast Retailing Co. ▲ 9983 JP

Est. sales Est. EPS Total 12-month 1-year total Female board

Apparel growth 11% assets sales return membership

growth

0%

54%

8.9%

$15b

$19b

Fast-fashion company with the most stores, by country The Japanese company is ramping up overseas

◼ Fast Retailing ◼ H&M ◼ Inditex expansion in a bid to overtake Inditex and H&M as the

world’s biggest apparel retailer by revenue. Its push

abroad means Uniqlo’s international operations should

account for a majority of Fast Retailing’s sales and

operating profit within the next one to two years.

DATA: COMPANY REPORTS