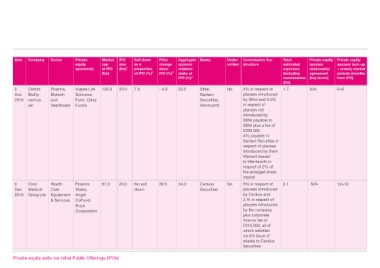

Page 10 - Private Equity Exits via Initial Public Offerings 2016

P. 10

Date Company Sector Private Market IPO Sell down Price Aggregate Banks Under- Commission /fee Total Private equity Private equity

equity cap size as a change sponsor written structure estimated sponsor sponsor lock-up

sponsor(s) at IPO (£m) 1 proportion since retained expenses relationship + orderly market

3

(£m) of IPO (%) 2 IPO (%) stake at (including agreement periods (months

4

IPO (%) commissions (key terms) from IPO)

(£m)

6 Oxford Pharma, Vulpes Life 136.0 20.0 7.8 - 4.0 23.5 Stifel, No 4% in respect of 1.7 N/A 6+6

Dec BioDy- Biotech Sciences Sanlam placees introduced

2016 namics and Fund, Odey Securities, by Stifel and 0.5%

plc Healthcare Funds Wentworth in respect of

placees not

introduced by

Stifel payable to

Stifel plus a fee of

£200,000

4% payable to

Sanlam Securitas in

respect of placees

introduced by them

Warrant issued

to Wentworth in

respect of 2% of

the enlarged share

capital

9 Creo Health Finance 61.3 20.0 No sell 39.5 34.3 Cenkos No 5% in respect of 2.1 N/A 12+12

Dec Medical Care Wales, down Securities placees introduced

2016 Group plc Equipment Angel by Cenkos and

& Services CoFund, 2.% in respect of

Hoya placees introduced

Corporation by the company

plus corporate

finance fee of

£315,000, all of

which satisfied

via the issue of

shares to Cenkos

Securities

Private equity exits via Initial Public Offerings (IPOs)