Page 8 - Private Equity Exits via Initial Public Offerings 2016

P. 8

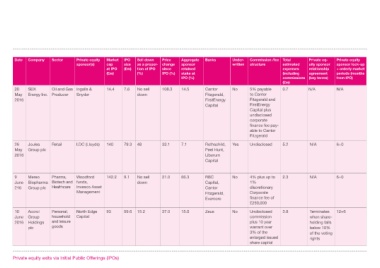

Date Company Sector Private equity Market IPO Sell down Price Aggregate Banks Under- Commission /fee Total Private eq- Private equity

sponsor(s) cap size as a propor- change sponsor written structure estimated uity sponsor sponsor lock-up

at IPO (£m) tion of IPO since retained expenses relationship + orderly market

(£m) (%) IPO (%) stake at (including agreement periods (months

IPO (%) commissions (key terms) from IPO)

(£m)

20 SDX Oil and Gas Ingalls & 14.4 7.6 No sell 108.3 14.5 Cantor No 5% payable 0.7 N/A N/A

May Energy Inc. Producer Snyder down Fitzgerald, to Cantor

2016 FirstEnergy Fitzgerald and

Capital FirstEnergy

Capital plus

undisclosed

corporate

finance fee pay-

able to Cantor

Fitzgerald

26 Joules Retail LDC (Lloyds) 140 79.3 48 33.1 7.1 Rothschild, Yes Undisclosed 5.2 N/A 6+0

May Group plc Peel Hunt,

2016 Liberum

Capital

9 Mereo Pharma, Woodford 142.2 9.1 No sell 21.0 66.3 RBC No 4% plus up to 2.3 N/A 6+0

June Biopharma Biotech and funds, down Capital, 1%

216 Group plc Healthcare Invesco Asset Cantor discretionary

Management Fitzgerald, Corporate

Evercore finance fee of

£250,000

10 Accrol Personal, North Edge 93 59.6 15.2 37.0 15.0 Zeus No Undisclosed 3.8 Terminates 12+6

June Group household Capital commission when share-

2016 Holdings and leisure plus 10 year holding falls

plc goods warrant over below 10%

3% of the of the voting

enlarged issued rights

share capital

Private equity exits via Initial Public Offerings (IPOs)