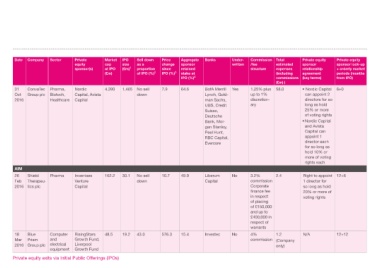

Page 6 - Private Equity Exits via Initial Public Offerings 2016

P. 6

Date Company Sector Private Market IPO Sell down Price Aggregate Banks Under- Commission Total Private equity Private equity

equity cap size as a change sponsor written /fee estimated sponsor sponsor lock-up

sponsor(s) at IPO (£m) 1 proportion since retained structure expenses relationship + orderly market

3

(£m) of IPO (%) 2 IPO (%) stake at (including agreement periods (months

4

IPO (%) commissions (key terms) from IPO)

(£m) )

31 ConvaTec Pharma, Nordic 4,390 1,465 No sell 7.9 64.6 BofA Merrill Yes 1.25% plus 58.0 • Nordic Capital 6+0

Oct Group plc Biotech, Capital, Avista down Lynch, Gold- up to 1% can appoint 2

2016 Healthcare Capital man Sachs, discretion- directors for so

UBS, Credit ary long as hold

Suisse, 25% or more

Deutsche of voting rights

Bank, Mor- • Nordic Capital

gan Stanley, and Avista

Peel Hunt, Capital can

RBC Capital, appoint 1

Evercore director each

for so long as

hold 10% or

more of voting

rights each

AIM

26 Shield Pharma Inventaes 162.2 30.1 No sell 10.7 49.9 Liberum No 3.2% 2.4 Right to appoint 12+6

Feb Therapeu- Venture down Capital commission 1 director for

2016 tics plc Capital Corporate so long as hold

finance fee 20% or more of

in respect voting rights

of placing

of £150,000

and up to

£400,000 in

respect of

warrants

18 Blue Computer RisingStars 48.5 19.2 43.0 576.3 15.4 Investec No 4% 1.2 N/A 12+12

Mar Prism and Growth Fund, commission (Company

2016 Group plc electrical Liverpool only)

equipment Growth Fund

Private equity exits via Initial Public Offerings (IPOs)