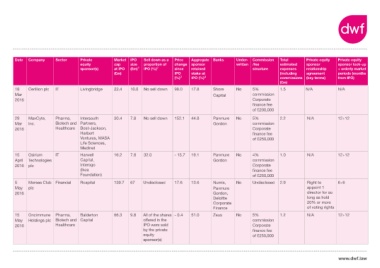

Page 7 - Private Equity Exits via Initial Public Offerings 2016

P. 7

Date Company Sector Private Market IPO Sell down as a Price Aggregate Banks Under- Commission Total Private equity Private equity

equity cap size proportion of change sponsor written /fee estimated sponsor sponsor lock-up

sponsor(s) at IPO (£m) 1 IPO (%) 2 since retained structure expenses relationship + orderly market

(£m) IPO stake at (including agreement periods (months

3

4

(%) IPO (%) commissions (key terms) from IPO)

(£m)

18 Cerillion plc IT Livingbridge 22.4 10.0 No sell down 98.0 17.8 Shore No 5% 1.5 N/A N/A

Mar Capital commission

2016 Corporate

finance fee

of £200,000

29 MaxCyte, Pharma, Intersouth 30.4 7.8 No sell down 152.1 44.8 Panmure No 5% 2.2 N/A 12+12

Mar Inc. Biotech and Partners, Gordon commission

2016 Healthcare Bost-Jackson, Corporate

Harbert finance fee

Ventures, MASA of £250,000

Life Sciences,

Medinet

15 Osirium IT Harwell 16.2 7.8 32.0 - 15.7 19.1 Panmure No 4% 1.0 N/A 12+12

April Technologies Capital, Gordon commission

2016 plc Interogo Corporate

(Ikea finance fee

Foundation) of £250,000

5 Morses Club Financial Rcapital 139.7 67 Undisclosed 17.6 13.6 Numis, No Undisclosed 2.9 Right to 6+6

May plc Panmure appoint 1

2016 Gordon, director for so

Deloitte long as hold

Corporate 20% or more

Finance of voting rights

15 Oncimmune Pharma, Balderton 66.3 9.8 All of the shares - 0.4 51.0 Zeus No 5% 1.2 N/A 12+12

May Holdings plc Biotech and Capital offered in the commission

2016 Healthcare IPO were sold Corporate

by the private finance fee

equity of £250,000

sponsor(s)

www.dwf.law