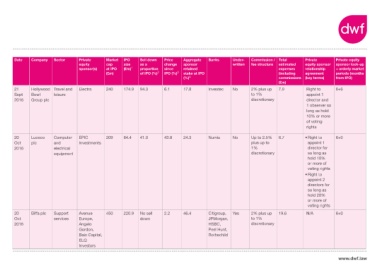

Page 5 - Private Equity Exits via Initial Public Offerings 2016

P. 5

Date Company Sector Private Market IPO Sell down Price Aggregate Banks Under- Commission / Total Private Private equity

equity cap size as a change sponsor written fee structure estimated equity sponsor sponsor lock-up

sponsor(s) at IPO (£m) 1 proportion since retained expenses relationship + orderly market

3

(£m) of IPO (%) 2 IPO (%) stake at IPO (including agreement periods (months

4

(%) commissions (key terms) from IPO)

(£m)

21 Hollywood Travel and Electra 240 174.9 94.3 6.1 17.8 Investec No 2% plus up 7.9 Right to 6+6

Sept Bowl leisure to 1% appoint 1

2016 Group plc discretionary director and

1 observer so

long as hold

10% or more

of voting

rights

20 Luceco Computer EPIC 209 84.4 41.0 43.8 24.3 Numis No Up to 2.5% 6.7 • Right to 6+0

Oct plc and Investments plus up to appoint 1

2016 electrical 1% director for

equipment discretionary so long as

hold 10%

or more of

voting rights

• Right to

appoint 2

directors for

so long as

hold 20%

or more of

voting rights

20 Biffa plc Support Avenue 450 220.9 No sell 2.2 46.4 Citigroup, Yes 2% plus up 19.6 N/A 6+0

Oct services Europe, down JPMorgan, to 1%

2016 Angelo HSBC, discretionary

Gordon, Peel Hunt,

Bain Capital, Rothschild

ELQ

Investors

www.dwf.law