Page 17 - Jones and Frank Benefits Enrollments Guide

P. 17

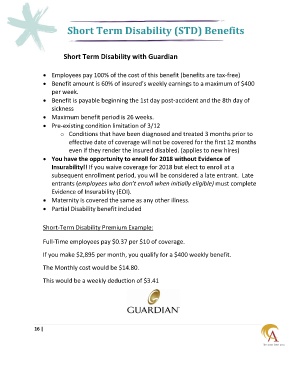

Short Term Disability (STD) Benefits

Short Term Disability with Guardian

Employees pay 100% of the cost of this benefit (benefits are tax-free)

Benefit amount is 60% of insured’s weekly earnings to a maximum of $400

per week.

Benefit is payable beginning the 1st day post-accident and the 8th day of

sickness

Maximum benefit period is 26 weeks.

Pre-existing condition limitation of 3/12

o Conditions that have been diagnosed and treated 3 months prior to

effective date of coverage will not be covered for the first 12 months

even if they render the insured disabled. (applies to new hires)

You have the opportunity to enroll for 2018 without Evidence of

Insurability!! If you waive coverage for 2018 but elect to enroll at a

subsequent enrollment period, you will be considered a late entrant. Late

entrants (employees who don’t enroll when initially eligible) must complete

Evidence of Insurability (EOI).

Maternity is covered the same as any other illness.

Partial Disability benefit included

Short-Term Disability Premium Example:

Full-Time employees pay $0.37 per $10 of coverage.

If you make $2,895 per month, you qualify for a $400 weekly benefit.

The Monthly cost would be $14.80.

This would be a weekly deduction of $3.41

16 |