Page 33 - Annual Report 2017

P. 33

TEXAS GULF BANCSHARES, INC. AND SUBSIDIARY

Notes to Consolidated Statements

December 31, 2016 and 2015

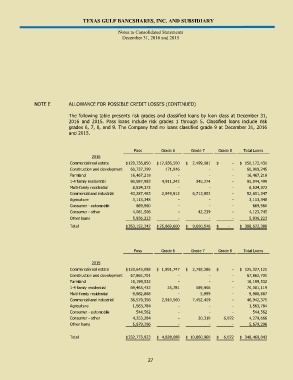

NOTE E ALLOWANCE FOR POSSIBLE CREDIT LOSSES (CONTINUED)

The following table presents risk grades and classified loans by loan class at December 31,

2016 and 2015. Pass loans include risk grades 1 through 5. Classified loans include risk

grades 6, 7, 8, and 9. The Company had no loans classified grade 9 at December 31, 2016

and 2015.

Pass Grade 6 Grade 7 Grade 8 Total Loans

2016

Commercial real estate $ 129,736,850 $ 17,936,500 $ 2,499,081 $ - $ 150,172,431

Construction and development 60,737,299 171,946 - - 60,909,245

Farmland 16,467,218 - - - 16,467,218

1-4 family residential 80,587,983 4,911,242 345,274 - 85,844,499

Multi-family residential 8,534,372 - - - 8,534,372

Commercial and industrial 43,287,483 2,849,912 6,713,952 - 52,851,347

Agriculture 3,113,348 - - - 3,113,348

Consumer - automobile 669,960 - - - 669,960

Consumer - other 4,081,506 - 42,239 - 4,123,745

Other loans 5,936,223 - - - 5,936,223

Total $ 353,152,242 $ 25,869,600 $ 9,600,546 $ - $ 388,622,388

Pass Grade 6 Grade 7 Grade 8 Total Loans

2015

Commercial real estate $ 120,643,088 $ 1,891,747 $ 2,792,286 $ - $ 125,327,121

Construction and development 67,862,701 - - - 67,862,701

Farmland 16,199,532 - - - 16,199,532

1-4 family residential 69,465,432 25,781 589,906 - 70,081,119

Multi-family residential 9,982,888 - 5,999 - 9,988,887

Commercial and industrial 36,579,356 2,910,560 7,452,459 - 46,942,375

Agriculture 1,563,784 - - - 1,563,784

Consumer - automobile 544,562 - - - 544,562

Consumer - other 4,253,284 - 20,310 6,072 4,279,666

Other loans 5,679,296 - - - 5,679,296

Total $ 332,773,923 $ 4,828,088 $ 10,860,960 $ 6,072 $ 348,469,043

27