Page 36 - Annual Report 2017

P. 36

TEXAS GULF BANCSHARES, INC. AND SUBSIDIARY

Notes to Consolidated Financial Statements

December 31, 2016 and 2015

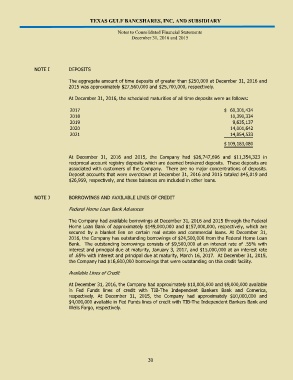

NOTE I DEPOSITS

The aggregate amount of time deposits of greater than $250,000 at December 31, 2016 and

2015 was approximately $27,560,000 and $25,700,000, respectively.

At December 31, 2016, the scheduled maturities of all time deposits were as follows:

2017 $ 60,301,434

2018 10,390,334

2019 9,635,137

2020 14,001,642

2021 14,854,533

$ 109,183,080

At December 31, 2016 and 2015, the Company had $26,747,696 and $11,354,323 in

reciprocal account registry deposits which are deemed brokered deposits. These deposits are

associated with customers of the Company. There are no major concentrations of deposits.

Deposit accounts that were overdrawn at December 31, 2016 and 2015 totaled $45,019 and

$26,959, respectively, and these balances are included in other loans.

NOTE J BORROWINGS AND AVAILABLE LINES OF CREDIT

Federal Home Loan Bank Advances

The Company had available borrowings at December 31, 2016 and 2015 through the Federal

Home Loan Bank of approximately $149,000,000 and $157,000,000, respectively, which are

secured by a blanket lien on certain real estate and commercial loans. At December 31,

2016, the Company has outstanding borrowings of $24,500,000 from the Federal Home Loan

Bank. The outstanding borrowings consists of $9,500,000 at an interest rate of .55% with

interest and principal due at maturity, January 3, 2017, and $15,000,000 at an interest rate

of .65% with interest and principal due at maturity, March 16, 2017. At December 31, 2015,

the Company had $16,600,000 borrowings that were outstanding on this credit facility.

Available Lines of Credit

At December 31, 2016, the Company had approximately $10,000,000 and $9,000,000 available

in Fed Funds lines of credit with TIB-The Independent Bankers Bank and Comerica,

respectively. At December 31, 2015, the Company had approximately $10,000,000 and

$4,000,000 available in Fed Funds lines of credit with TIB-The Independent Bankers Bank and

Wells Fargo, respectively.

30