Page 39 - Annual Report 2017

P. 39

TEXAS GULF BANCSHARES, INC. AND SUBSIDIARY

Notes to Consolidated Statements

December 31, 2016 and 2015

NOTE K COMMITMENTS AND CONTINGENT LIABILITIES (CONTINUED)

Legal Matters

The Company is subject to claims and lawsuits which arise primarily in the ordinary course of

business. Based on information presently available and advice received from legal counsel

representing the Company, it is the opinion of management that the disposition or ultimate

determination of such claims and lawsuits will not have a material adverse effect on the

financial position of the Company.

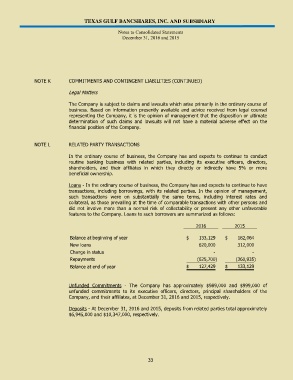

NOTE L RELATED PARTY TRANSACTIONS

In the ordinary course of business, the Company has and expects to continue to conduct

routine banking business with related parties, including its executive officers, directors,

shareholders, and their affiliates in which they directly or indirectly have 5% or more

beneficial ownership.

Loans - In the ordinary course of business, the Company has and expects to continue to have

transactions, including borrowings, with its related parties. In the opinion of management,

such transactions were on substantially the same terms, including interest rates and

collateral, as those prevailing at the time of comparable transactions with other persons and

did not involve more than a normal risk of collectability or present any other unfavorable

features to the Company. Loans to such borrowers are summarized as follows:

2016 2015

Balance at beginning of year $ 133,129 $ 182,064

New loans 620,000 312,000

Change in status - -

Repayments (625,700) (360,935)

Balance at end of year $ 127,429 $ 133,129

Unfunded Commitments - The Company has approximately $989,000 and $999,000 of

unfunded commitments to its executive officers, directors, principal shareholders of the

Company, and their affiliates, at December 31, 2016 and 2015, respectively.

Deposits - At December 31, 2016 and 2015, deposits from related parties total approximately

$6,945,000 and $10,347,000, respectively.

33