Page 42 - Annual Report 2017

P. 42

TEXAS GULF BANCSHARES, INC. AND SUBSIDIARY

Notes to Consolidated Financial Statements

December 31, 2016 and 2015

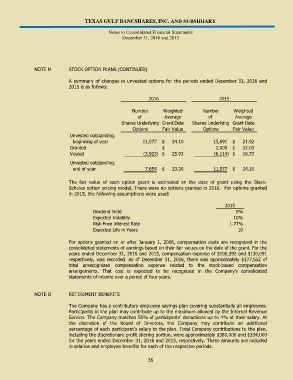

NOTE N STOCK OPTION PLANS (CONTINUED)

A summary of changes in unvested options for the periods ended December 31, 2016 and

2015 is as follows:

2016 2015

Number Weighted Number Weighted

of Average of Average

Shares Underlying Grant Date Shares Underlying Grant Date

Options Fair Value Options Fair Value

Unvested outstanding,

beginning of year 11,577 $ 24.10 15,691 $ 21.92

Granted - $ - 2,000 $ 32.03

Vested (3,923) $ 25.93 (6,114) $ 16.73

Unvested outstanding,

end of year 7,654 $ 23.20 11,577 $ 24.10

The fair value of each option grant is estimated on the date of grant using the Black-

Scholes option pricing model. There were no options granted in 2016. For options granted

in 2015, the following assumptions were used:

2015

Dividend Yield 0%

Expected Volatility 10%

Risk Free Interest Rate 1.77%

Expected Life in Years 10

For options granted on or after January 1, 2006, compensation costs are recognized in the

consolidated statements of earnings based on their fair values on the date of the grant. For the

years ended December 31, 2016 and 2015, compensation expense of $100,392 and $130,091

respectively, was recorded. As of December 31, 2016, there was approximately $177,552 of

total unrecognized compensation expense related to the stock-based compensation

arrangements. That cost is expected to be recognized in the Company’s consolidated

statements of income over a period of four years.

NOTE O RETIREMENT BENEFITS

The Company has a contributory employee savings plan covering substantially all employees.

Participants in the plan may contribute up to the maximum allowed by the Internal Revenue

Service. The Company matches 50% of participants’ deductions up to 4% of their salary. At

the discretion of the Board of Directors, the Company may contribute an additional

percentage of each participant’s salary to the plan. Total Company contributions to the plan,

including the discretionary profit sharing portion, were approximately $380,000 and $334,000

for the years ended December 31, 2016 and 2015, respectively. These amounts are included

in salaries and employee benefits for each of the respective periods.

36