Page 46 - Annual Report 2017

P. 46

TEXAS GULF BANCSHARES, INC. AND SUBSIDIARY

Notes to Consolidated Financial Statements

December 31, 2016 and 2015

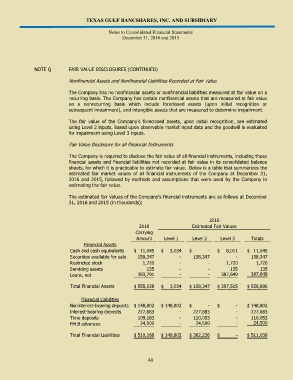

NOTE Q FAIR VALUE DISCLOSURES (CONTINUED)

Nonfinancial Assets and Nonfinancial Liabilities Recorded at Fair Value

The Company has no nonfinancial assets or nonfinancial liabilities measured at fair value on a

recurring basis. The Company has certain nonfinancial assets that are measured at fair value

on a nonrecurring basis which include foreclosed assets (upon initial recognition or

subsequent impairment), and intangible assets that are measured to determine impairment.

The fair value of the Company’s foreclosed assets, upon initial recognition, are estimated

using Level 2 inputs, based upon observable market input data and the goodwill is evaluated

for impairment using Level 3 inputs.

Fair Value Disclosure for all Financial Instruments

The Company is required to disclose the fair value of all financial instruments, including those

financial assets and financial liabilities not recorded at fair value in its consolidated balance

sheets, for which it is practicable to estimate fair value. Below is a table that summarizes the

estimated fair market values of all financial instruments of the Company at December 31,

2016 and 2015, followed by methods and assumptions that were used by the Company in

estimating the fair value.

The estimated fair values of the Company's financial instruments are as follows at December

31, 2016 and 2015 (in thousands):

2016

2016 Estimated Fair Values

Carrying

Amount Level 1 Level 2 Level 3 Totals

Financial Assets

Cash and cash equivalents $ 11,045 $ 3,034 $ - $ 8,011 $ 11,045

Securities available for sale 158,347 - 158,347 - 158,347

Restricted stock 1,720 - - 1,720 1,720

Servicing assets 135 - - 135 135

Loans, net 383,791 - - 387,649 387,649

Total Financial Assets $ 555,038 $ 3,034 $ 158,347 $ 397,515 $ 558,896

Financial Liabilities

Noninterest-bearing deposits $ 148,802 $ 148,802 $ - $ - $ 148,802

Interest-bearing deposits 227,683 - 227,683 - 227,683

Time deposits 109,183 - 110,053 - 110,053

FHLB advances 24,500 - 24,500 - 24,500

Total Financial Liabilities $ 510,168 $ 148,802 $ 362,236 $ - $ 511,038

40