Page 47 - Annual Report 2017

P. 47

TEXAS GULF BANCSHARES, INC. AND SUBSIDIARY

Notes to Consolidated Financial Statements

December 31, 2016 and 2015

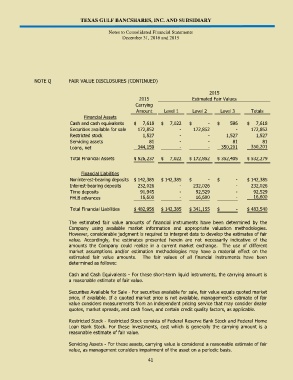

NOTE Q FAIR VALUE DISCLOSURES (CONTINUED)

2015

2015 Estimated Fair Values

Carrying

Amount Level 1 Level 2 Level 3 Totals

Financial Assets

Cash and cash equivalents $ 7,618 $ 7,022 $ - $ 596 $ 7,618

Securities available for sale 172,852 - 172,852 - 172,852

Restricted stock 1,527 - - 1,527 1,527

Servicing assets 81 - - 81 81

Loans, net 344,159 - - 350,201 350,201

Total Financial Assets $ 526,237 $ 7,022 $ 172,852 $ 352,405 $ 532,279

Financial Liabilities

Noninterest-bearing deposits $ 142,385 $ 142,385 $ - $ - $ 142,385

Interest-bearing deposits 232,026 - 232,026 - 232,026

Time deposits 91,945 - 92,529 - 92,529

FHLB advances 16,600 - 16,600 - 16,600

Total Financial Liabilities $ 482,956 $ 142,385 $ 341,155 $ - $ 483,540

The estimated fair value amounts of financial instruments have been determined by the

Company using available market information and appropriate valuation methodologies.

However, considerable judgment is required to interpret data to develop the estimates of fair

value. Accordingly, the estimates presented herein are not necessarily indicative of the

amounts the Company could realize in a current market exchange. The use of different

market assumptions and/or estimation methodologies may have a material effect on the

estimated fair value amounts. The fair values of all financial instruments have been

determined as follows:

Cash and Cash Equivalents - For these short-term liquid instruments, the carrying amount is

a reasonable estimate of fair value.

Securities Available for Sale - For securities available for sale, fair value equals quoted market

price, if available. If a quoted market price is not available, management’s estimate of fair

value considers measurements from an independent pricing service that may consider dealer

quotes, market spreads, and cash flows, and certain credit quality factors, as applicable.

Restricted Stock - Restricted Stock consists of Federal Reserve Bank Stock and Federal Home

Loan Bank Stock. For these investments, cost which is generally the carrying amount is a

reasonable estimate of fair value.

Servicing Assets - For these assets, carrying value is considered a reasonable estimate of fair

value, as management considers impairment of the asset on a periodic basis.

41