Page 45 - Annual Report 2017

P. 45

TEXAS GULF BANCSHARES, INC. AND SUBSIDIARY

Notes to Consolidated Statements

December 31, 2016 and 2015

NOTE Q FAIR VALUE DISCLOSURES (CONTINUED)

In general, fair value is based upon quoted market prices, where available. If such quoted

market prices are not available, fair value is based upon internally developed models that

primarily use observable market-based parameters as inputs. Valuation adjustments may be

made to ensure that assets or liabilities are recorded at fair value. These adjustments may

include amounts to reflect counterparty credit quality and creditworthiness, among other

things, as well as unobservable parameters. Any such valuation adjustments are applied

consistently over time.

The Company’s valuation methodologies may produce a fair value calculation that may not

be indicative of net realizable value or reflective of future fair values. While management

believes the Company’s valuation methodologies are appropriate and consistent with other

market participants, the use of different methodologies or assumptions to determine the fair

value of certain financial instruments could result in a different estimate of fair value at the

reporting date.

During the year ended December 31, 2016 and 2015, there were no transfers of financial

assets or liabilities within the fair value hierarchy.

Financial Instruments Recorded at Fair Value

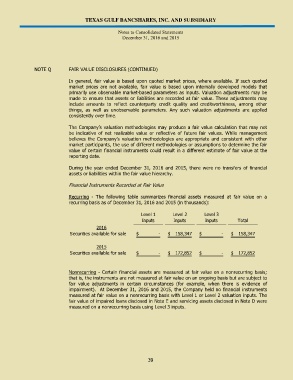

Recurring - The following table summarizes financial assets measured at fair value on a

recurring basis as of December 31, 2016 and 2015 (in thousands):

Level 1 Level 2 Level 3

Inputs Inputs Inputs Total

2016

Securities available for sale $ - $ 158,347 $ - $ 158,347

2015

Securities available for sale $ - $ 172,852 $ - $ 172,852

Nonrecurring - Certain financial assets are measured at fair value on a nonrecurring basis;

that is, the instruments are not measured at fair value on an ongoing basis but are subject to

fair value adjustments in certain circumstances (for example, when there is evidence of

impairment). At December 31, 2016 and 2015, the Company held no financial instruments

measured at fair value on a nonrecurring basis with Level 1 or Level 2 valuation inputs. The

fair value of impaired loans disclosed in Note E and servicing assets disclosed in Note D were

measured on a nonrecurring basis using Level 3 inputs.

39