Page 43 - Annual Report 2017

P. 43

TEXAS GULF BANCSHARES, INC. AND SUBSIDIARY

Notes to Consolidated Financial Statements

December 31, 2016 and 2015

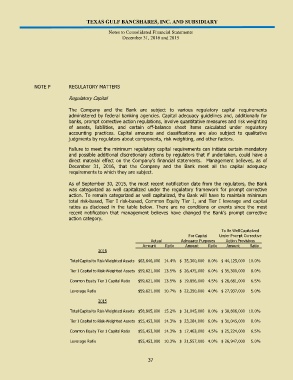

NOTE P REGULATORY MATTERS

Regulatory Capital

The Company and the Bank are subject to various regulatory capital requirements

administered by federal banking agencies. Capital adequacy guidelines and, additionally for

banks, prompt corrective action regulations, involve quantitative measures and risk weighting

of assets, liabilities, and certain off-balance sheet items calculated under regulatory

accounting practices. Capital amounts and classifications are also subject to qualitative

judgments by regulators about components, risk weighting, and other factors.

Failure to meet the minimum regulatory capital requirements can initiate certain mandatory

and possible additional discretionary actions by regulators that if undertaken, could have a

direct material effect on the Company’s financial statements. Management believes, as of

December 31, 2016, that the Company and the Bank meet all the capital adequacy

requirements to which they are subject.

As of September 30, 2015, the most recent notification date from the regulators, the Bank

was categorized as well capitalized under the regulatory framework for prompt corrective

action. To remain categorized as well capitalized, the Bank will have to maintain minimum

total risk-based, Tier I risk-based, Common Equity Tier 1, and Tier I leverage and capital

ratios as disclosed in the table below. There are no conditions or events since the most

recent notification that management believes have changed the Bank’s prompt corrective

action category.

To Be Well Capitalized

For Capital Under Prompt Corrective

Actual Adequacy Purposes Action Provisions

Amount Ratio Amount Ratio Amount Ratio

2016

Total Capital to Risk-Weighted Assets $ 63,646,000 14.4% $ 35,300,000 8.0% $ 44,125,000 10.0%

Tier I Capital to Risk-Weighted Assets $ 59,621,000 13.5% $ 26,475,000 6.0% $ 35,300,000 8.0%

Common Equity Tier 1 Capital Ratio $ 59,621,000 13.5% $ 19,856,000 4.5% $ 28,681,000 6.5%

Leverage Ratio $ 59,621,000 10.7% $ 22,350,000 4.0% $ 27,937,000 5.0%

2015

Total Capital to Risk-Weighted Assets $ 58,905,000 15.2% $ 31,045,000 8.0% $ 38,806,000 10.0%

Tier I Capital to Risk-Weighted Assets $ 55,453,000 14.3% $ 23,284,000 6.0% $ 31,045,000 8.0%

Common Equity Tier 1 Capital Ratio $ 55,453,000 14.3% $ 17,463,000 4.5% $ 25,224,000 6.5%

Leverage Ratio $ 55,453,000 10.3% $ 21,557,000 4.0% $ 26,947,000 5.0%

37