Page 37 - Annual Report 2017

P. 37

TEXAS GULF BANCSHARES, INC. AND SUBSIDIARY

Notes to Consolidated Financial Statements

December 31, 2016 and 2015

NOTE K COMMITMENTS AND CONTINGENT LIABILITIES

Unfunded Loan Commitments

In the normal course of business, the Company enters into various transactions, which in

accordance with U.S. GAAP, are not included in its consolidated balance sheets. The

Company through its Bank subsidiary enters into these transactions to meet the financing

needs of its customers.

These financial instruments include commitments to extend credit for loans in process,

commercial lines of credit, revolving credit lines, overdraft protection lines, and standby

letters of credit at both fixed and variable rates of interest. These instruments involve, to

varying degrees, elements of credit and interest rate risk in excess of the amounts

recognized in the consolidated balance sheets. The contract or notional amounts of those

instruments reflect the extent of the involvement the Company has in particular classes of

financial instruments. The Company’s exposure to credit loss in the event of nonperformance

by the other party to the financial instrument for commitments to extend credit and standby

letters of credit is represented by the contractual notional amount of those instruments. The

Company uses the same credit policies in making these commitments and conditional

obligations as it does for on-balance-sheet instruments.

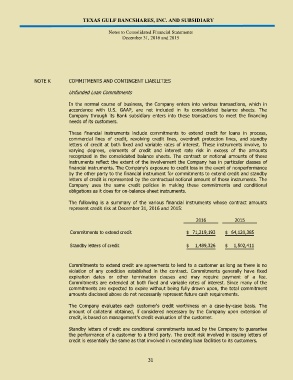

The following is a summary of the various financial instruments whose contract amounts

represent credit risk at December 31, 2016 and 2015:

2016 2015

Commitments to extend credit $ 71,219,193 $ 64,120,385

Standby letters of credit $ 1,489,326 $ 1,502,411

Commitments to extend credit are agreements to lend to a customer as long as there is no

violation of any condition established in the contract. Commitments generally have fixed

expiration dates or other termination clauses and may require payment of a fee.

Commitments are extended at both fixed and variable rates of interest. Since many of the

commitments are expected to expire without being fully drawn upon, the total commitment

amounts disclosed above do not necessarily represent future cash requirements.

The Company evaluates each customer's credit worthiness on a case-by-case basis. The

amount of collateral obtained, if considered necessary by the Company upon extension of

credit, is based on management's credit evaluation of the customer.

Standby letters of credit are conditional commitments issued by the Company to guarantee

the performance of a customer to a third party. The credit risk involved in issuing letters of

credit is essentially the same as that involved in extending loan facilities to its customers.

31